Egypt will receive the first tranche of an expanded loan agreement with the International Monetary Fund (IMF) next week, Prime Minister Mostafa Madbouly said during a press conference on Saturday.

The expanded $8 billion financial support program enables the immediate release of $820 million, according to a statement by the IMF.

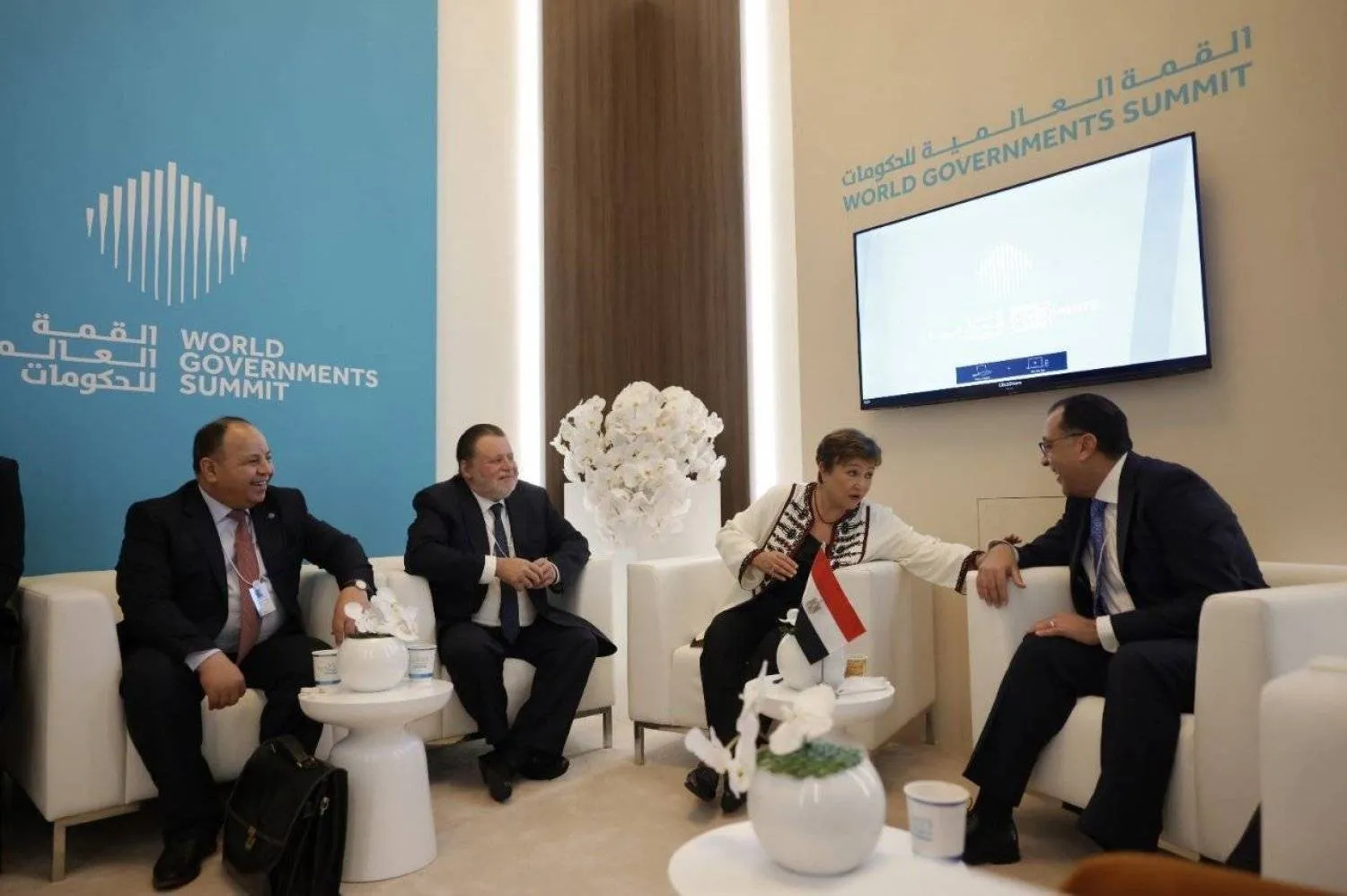

Madbouly noted that he was following up with Central Bank Governor Hassan Abdullah on foreign currency flows, indicating that the first installment of the IMF loan will be received next week.

He also stressed that the government will work to ensure the completion of all reform paths and the return of dollar flows to normal.

The IMF had announced that its Executive Board had conducted the first and second review of Egypt’s economic program, and decided to increase the original agreement with Egypt by $5 billion.

In a statement, the Fund said that Egypt can withdraw about $820 million immediately, indicating that implementing economic policies within the framework of the program is important to confront the macroeconomic challenges in this country.

It continued that the Ras Al-Hekma investment deal will ease financing pressures in the near term, stressing that external shocks and delayed policy adjustments affected economic activity in Egypt, which led to a slowdown in growth to 3.8 percent in the fiscal year 2022-2023.

“The difficult external environment generated by Russia’s war in Ukraine was subsequently aggravated by the conflict in Gaza and Israel, as well as tensions in the Red Sea. These developments increased the complexity of macroeconomic challenges and called for decisive domestic policy action supported by a more robust external financing package, including from the IMF,” the statement read.