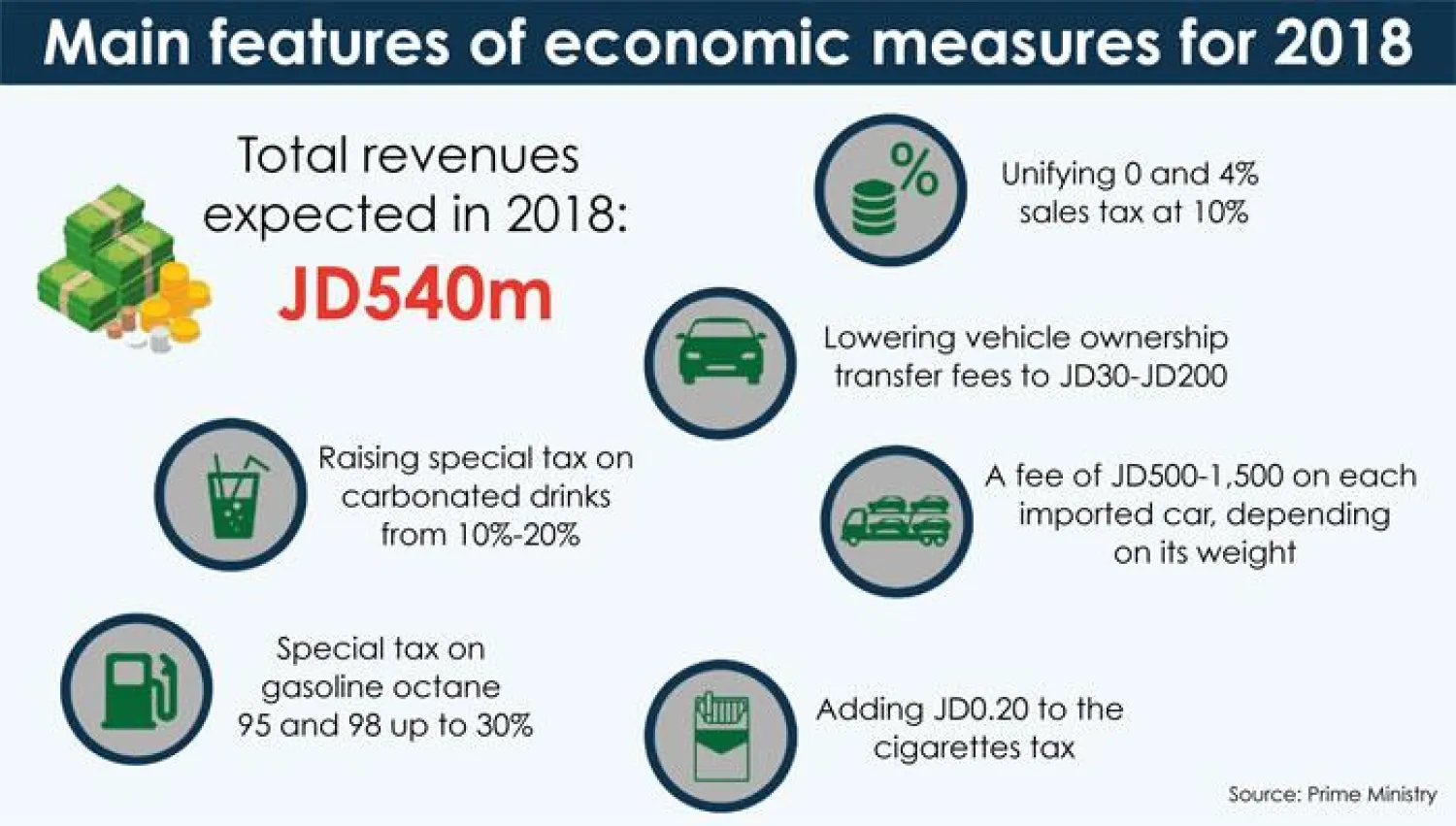

The Jordanian government decided to impose new taxes on several goods and products in order to reduce the public debt. All sales tax exemptions (zero and 4 percent) have been modified at a unified rate of 10 percent while the tax on Octane 95 and 98 was raised to 30 percent instead of 24 percent.

The kingdom’s economy was highly influenced by the crises in Iraq and Syria and the public debt was estimated at USD35b. Jordan, which suffers a scarcity of water and natural resources, imports 98 percent of its energy needs.

The Cabinet set the threshold annual household income for the segments eligible for the cash support at JD12,000, while individuals who apply for the subsidy should prove that their yearly income does not exceed JD6,000. The cabinet called on citizens to post their applications through the website, announcing that so far 230,000 families have registered as beneficiaries. For beneficiaries from the National Aid Fund (whose number is around 344,000), the per capita value of the cash subsidy is JD33, while eligible beneficiaries to receive the JD27.

Government statistics revealed that the community segments receiving direct monetary support wont be affected by the measures taken by the government within a financial economic reforms program.

Notably, the reduced taxes on essential commodities remain unchanged, including sugar, rice, flour, cooking oil, lamb, beef, chicken, fish, fresh milk, children’s milk, eggs, tea, school stationery, pesticides, fertilizers and veterinary medicines.