Saudi Binzagr Company announced Tuesday that the Industrial Valley in King Abdullah Economic City (KAEC) started the trial phase for the largest integrated logistics center in the Kingdom worth more than one billion riyals ($266,600).

Saudi Arabia has been working to expand its ports and establish logistics centers to facilitate import and export.

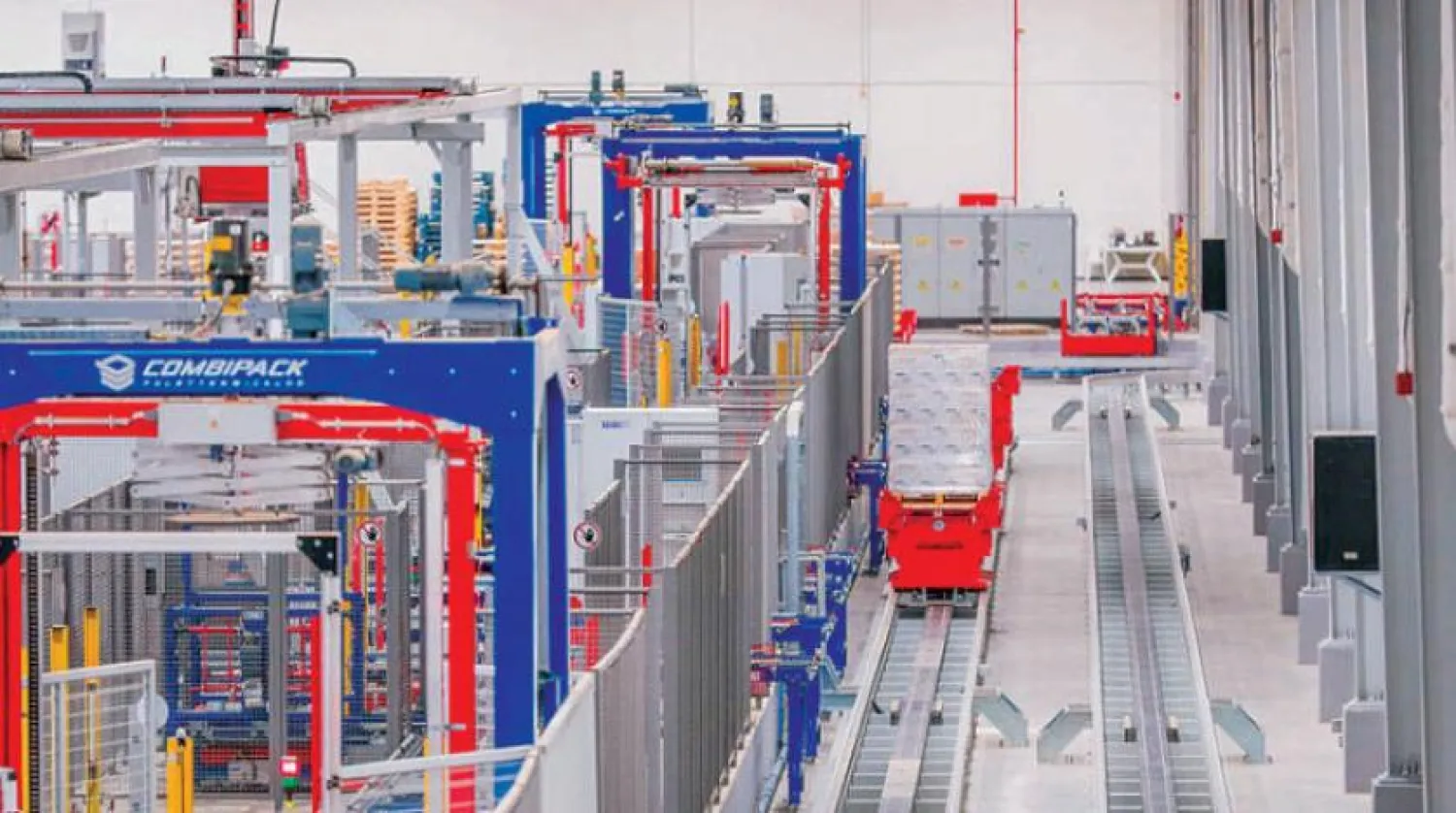

The center is one of the largest in the region, with an area of 97,000 square meters and a capacity of more than 110,000 pallets for storing medical and food products.

It includes 50-meter high shelves that operate automatically with the latest technologies for storing and rearranging goods, in addition to 56 gates to receive all types of trucks, and parking lots for 180 trucks at the same time to facilitate loading and unloading.

A strategic partnership has been concluded for storing and distributing medicines with the National Unified Procurement Company for Medical Supplies (NUPCO) and for storing Binzagr Company's food products as well as those for international companies in KAEC Industrial Valley.

Binzagr CEO Ahmed Binzagr announced that the center’s construction was in line with the latest international standards.

“It includes a mechanism to facilitate storage, distribution, transportation and value-added services.”

Binzagr also spoke of an area of more than 8,000 square meters for all customers to provide consumer products for the Saudi market.

KAEC CEO Ahmed bin Ibrahim Linjawy said Binzagr selected the Industrial Valley as the headquarters of its logistic services center because it is one of the largest logistics platforms in the Kingdom and a major advanced connection hub in international trade between the east and the west.

Linjawy pointed out that KAEC and its strategic sectors have become part of the Kingdom’s ambitious Vision 2030 by supporting the industrial sector and attracting foreign investments.

CEO of TAD Logistics Khalid al-Bawardi told Asharq Al-Awsat that the expansion of ports, the establishment of logistical centers and the simplification of import and export procedures are necessary to achieve Vision 2030’s objective to make the Kingdom a global logistics hub and help it advance in the global index of logistics services from 48th in the world to 25th, and become the first regionally.

This step will attract local and global investments, enable the Kingdom to create jobs and increase the contribution of the logistics sector to the GDP, Bawardi explained.