Egypt's net foreign assets (NFAs) declined by 49.8 billion Egyptian pounds in February as pressure on the currency continued to build.

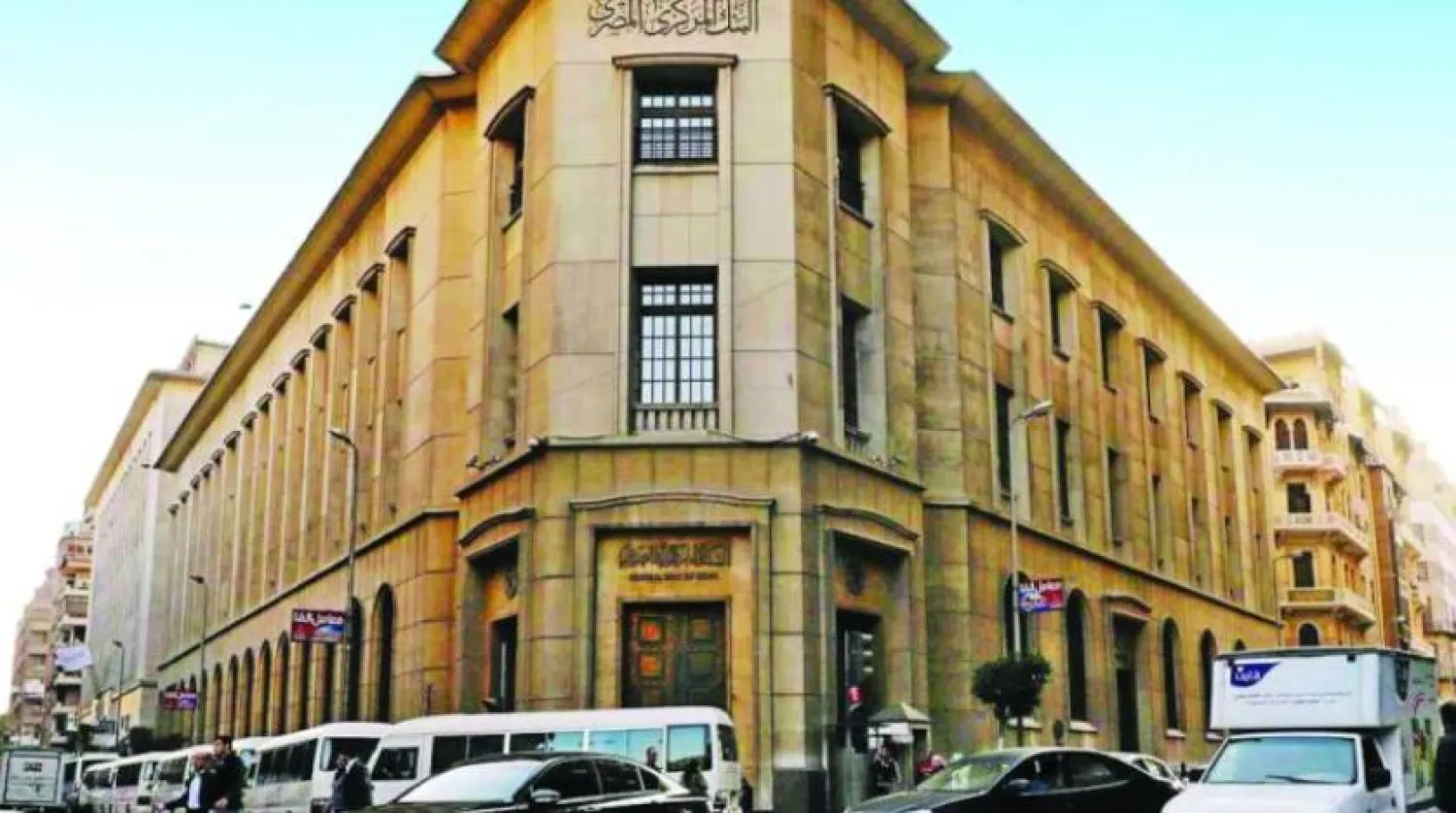

The second drop in as many months took NFAs to a negative 704.23 billion Egyptian pounds from minus 654.43 billion at the end of January, the Central Bank of Egypt data showed.

That equates to a February decline of $1.31 billion using end-of-month central bank exchange rates, Reuters calculations show.

The central bank allowed the Egyptian pound's official price to depreciate against the dollar by 1.4% in February.

The official exchange rate on Sunday was 30.9, while street dealers were offering to buy dollars for 36 pounds, down from 35 last week.

NFAs, which represent banking system assets owed by non-residents minus liabilities, have helped the central bank to support Egypt's currency over the past 18 months.

Egypt's NFAs had stood at a positive 248 billion pounds in September 2021, before the decline began.

Meanwhile, the National Bank of Egypt (NBE) and Banque Misr have recently issued two new certificates of deposit (CDs) with fixed yields of 19% and a decreasing yield of 22%.

The first certificate is fixed for three years at a rate of 19% annually, and the return is paid monthly. The other CD has a decreasing yield of 22%, disbursing a yield of 22% over the first year, 18% over the second year, and 16% over the third year, according to the Middle East News Agency (MENA).

The issuance of these certificates reflects the positive outlook of a drop in interest rates in the coming period and a gradual decline in inflation amid stability in the markets, added MENA.

Moreover, the central bank announced on Thursday that the Monetary Policy Committee (MPC) decided to raise key policy rates by 200 bps.

In its meeting, the overnight deposit rate, overnight lending rate, and the rate of the main operation were raised by 200 bps to 18.25%, 19.25%, and 18.75%, respectively.

Meanwhile, Egyptian Exchange (EGX) indexes posted collective gains at the close of Sunday's trading session.

The market capital gained about 18 billion pounds to close at 1.067 trillion pounds, amid transactions that totaled 2 billion pounds.

The EGX 30 benchmark index was up by 1.68%, registering 16,694.46 points.

The broader EGX 70 EWI index of the leading small and mid-cap enterprises (SMEs) increased by 1.41%, ending at 2,846.98 points.

The all-embracing EGX 100 index rose by 1.63%, closing at 4,301.27 points.