Somali President Hassan Sheikh Mohamud unveiled a three-pronged political and legal strategy to nullify what he described as Israeli recognition of the breakaway region of Somaliland, warning that such a move threatens Somalia’s sovereignty and regional stability.

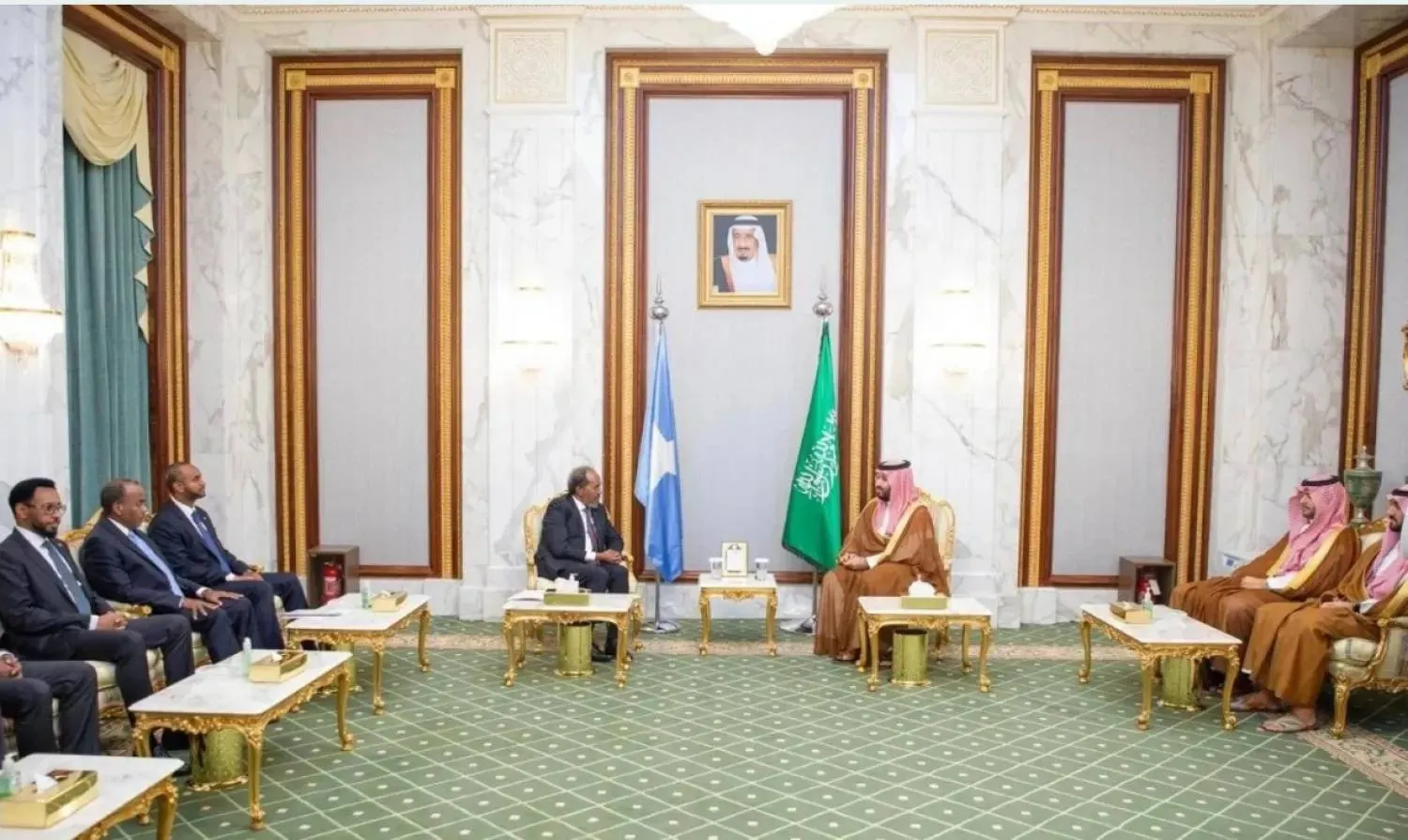

Speaking to Asharq Al-Awsat, Mohamud said his government is acting in close coordination with partners led by Saudi Arabia to safeguard stability and shield the Horn of Africa from what he called “reckless escalation.”

Without naming specific countries, the Somali leader said some regional states may see the Israeli recognition as an opportunity to pursue “narrow, short-term interests at the expense of Somalia’s unity and regional stability.”

“I do not wish to name any particular country or countries,” he said. “But it is clear that some may view this recognition as a chance to achieve limited gains.”

He stressed that Somalia’s unity is a “red line,” adding that Mogadishu has taken firm positions to protect national sovereignty. “We warn against being misled by reckless Israeli adventurism,” he said.

Three parallel steps

Mohamud was referring to recognition announced by Israeli Prime Minister Benjamin Netanyahu of the self-declared Republic of Somaliland as an independent state.

“I affirm with the utmost clarity and firmness that any recognition of Somaliland as an independent state constitutes a blatant violation of the sovereignty and unity of the Federal Republic of Somalia,” he said.

He described the move as a grave breach of international law, the UN Charter, and African Union resolutions that uphold respect for inherited African borders.

On that basis, Somalia has adopted and will continue to pursue three parallel measures, he revealed.

The first involves immediate diplomatic action through the UN, African Union, and Organization of Islamic Cooperation to reject and legally and politically invalidate the recognition.

Mohamud said Somalia called for and secured a formal session at the UN Security Council to address what he termed a “flagrant Israeli violation” of Somalia’s sovereignty and territorial integrity.

The session, he said, marked a significant diplomatic victory for Mogadishu, particularly given Somalia’s current membership on the council.

He expressed “deep appreciation” for statements of solidarity and condemnation issued by the African Union, Arab League, OIC, Gulf Cooperation Council, Intergovernmental Authority on Development (IGAD), and the EU, among others.

The second step centers on coordinating a unified Arab, Islamic, and African position. Mohamud praised Saudi Arabia for being among the first to issue a clear statement rejecting any infringement on Somalia’s unity.

He said the Saudi position reflects the Kingdom’s longstanding commitment to state sovereignty and territorial integrity, reinforced by the Saudi cabinet’s “firm and principled” support for Somalia during what he described as a delicate moment.

The third step focuses on strengthening internal national dialogue to address political issues within the framework of a single Somali state, free from external interference or dictates.

Regional security

Mohamud warned that if left unchecked, the recognition could set a “dangerous precedent and undermine regional and international peace and security.”

He said it could embolden separatist movements not only in the Horn of Africa but across Africa and the Arab world, citing developments in countries such as Sudan and Yemen as evidence of the high cost of state fragmentation.

“This concerns a vital global shipping artery and core Arab national security,” he said, referring to the Red Sea.

“Any political or security tension along Somalia’s coast will directly affect international trade and energy security.”

He added that instability would impact Red Sea littoral states, particularly Saudi Arabia, Egypt, Sudan, Eritrea, Yemen, and Jordan. “Preserving Somalia’s unity is a cornerstone of collective Red Sea security,” he said.

Strategic foothold

Mohamud argued that Israel’s objective goes beyond political recognition.

“We believe the goal extends beyond a political gesture,” he told Asharq Al-Awsat. “It includes seeking a strategic foothold in the Horn of Africa near the Red Sea, enabling influence over the Bab al-Mandeb Strait and threatening the national security of Red Sea states.”

He described the move as a test of Somali, Arab, and African resolve on issues of sovereignty and territorial unity, emphasizing that Somalia’s opposition to secession is a principled and enduring national stance supported widely in the Arab and African worlds, “foremost by Saudi Arabia.”

He rejected any attempt to turn Somalia into a battleground for regional or international rivalries. “We will not allow Somalia to become an arena for settling conflicts that do not serve our people’s interests or our region’s security,” he declared.

Saudi ties

Regarding Saudi-Somali relations, Mohamud described the partnership as “deep-rooted and strategic, rooted in shared history, religion, and a common destiny.” Saudi Arabia, he said, “remains a central partner in supporting Somalia’s stability, reconstruction, development, and Red Sea security.”

He voiced admiration for Saudi Arabia’s Vision 2030 and the economic and development gains achieved under the leadership of Custodian of the Two Holy Mosques King Salman bin Abdulaziz and Prince Mohammed bin Salman, Crown Prince and Prime Minister.

Asked about the recent Saudi Cabinet decision rejecting any attempt to divide Somalia, Mohamud said the federal government received it with “great appreciation and relief.”

He said the position extends the Kingdom’s historic support for Somalia’s territorial unity and sovereignty, reinforces regional stability, and sends an important message to the international community on the need to respect state sovereignty and refrain from interference in internal affairs.