Kuwait's al-Wafrah station is the hub for connecting neighboring countries with the future expansion of the interconnection network, said the CEO of GCC Interconnection Authority (GCCIA), Ahmed al-Ebrahim.

Ebrahim said that the Authority, in cooperation with specialists from the Kuwaiti Ministry of Electricity and Renewable Energy, has conducted technical and economic studies to harness the full potential of grid interconnectivity.

He added that the technical studies confirmed the need to build a new station compatible with the technical specifications of the stations of the Kuwait network at a voltage of 400 kilovolts.

The official noted that the economic goals of establishing the Wafrah station include saving installed capacity, especially with the increased summer electrical loads, and boosting interconnection to pass a larger capacity in support of emergencies to member states.

It also provides more significant opportunities for energy exchange by increasing the electrical interconnection capacity to achieve economical operation, increase the network's security and stability, and enable the integration of renewable energy and maximum utilization.

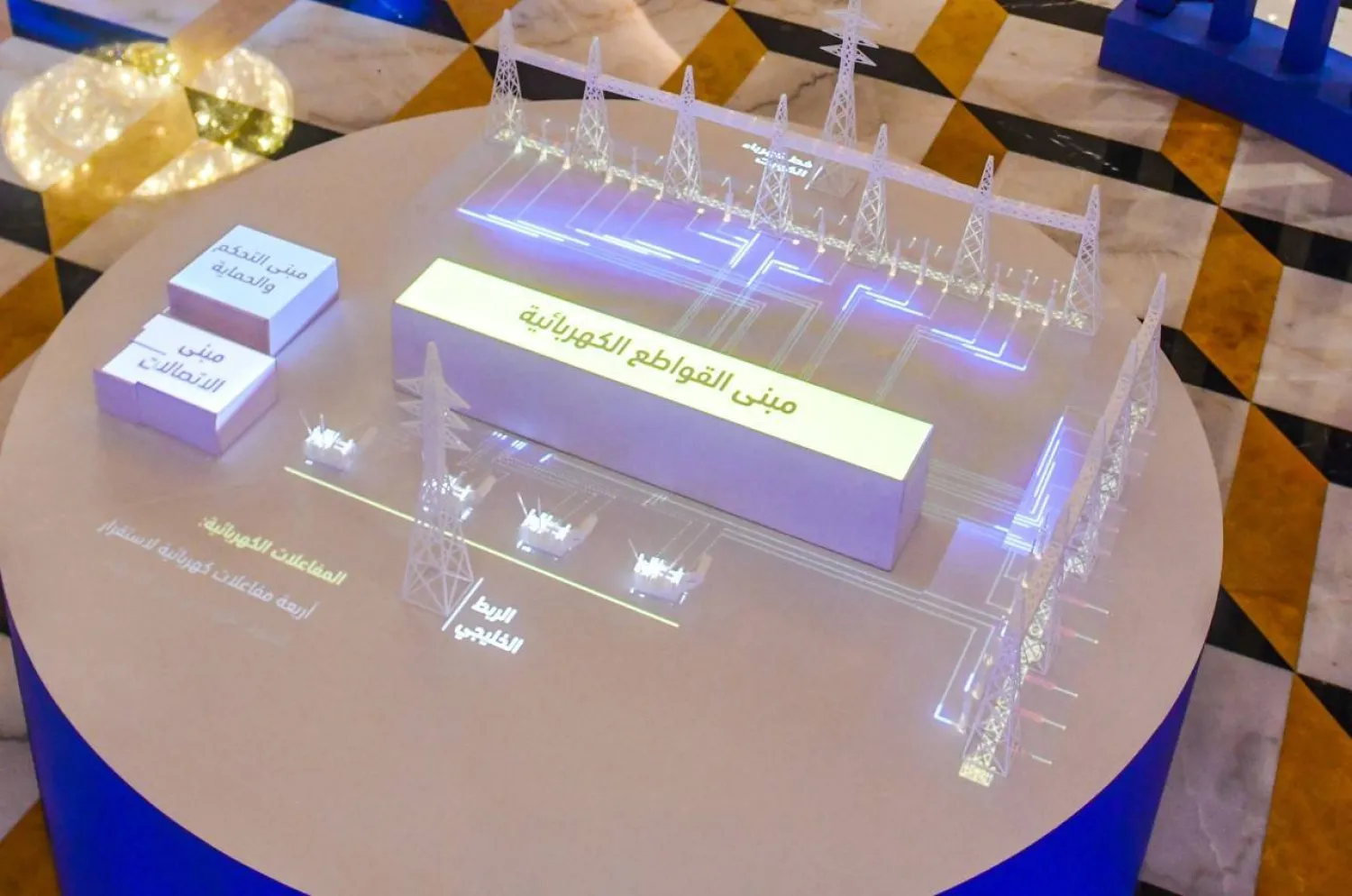

The CEO explained that the project consists of constructing a 400 kV substation in al-Wafra and constructing double-circuit overhead lines to connect the station with the al-Fadhili station in Saudi Arabia, with a length of approximately 300 km.

The project includes expanding the Fadhili station by adding electrical circuit breakers with a voltage of 400 kV to connect with the Wafra station. It also includes 400KV antennas to 3Z and 4Z stations to link with Kuwait Network.

Ebrahim noted that the project will take 24 months and will be completed at the end of December 2024.

The Authority was established based on the Unified Economic Agreement between the Gulf states, which was approved by the leaders in their second session in 1981, to link the networks of the GCC states, said Ebrahim.

He indicated that the Gulf Interconnection Project is an essential infrastructure linking project, achieving its most important strategic goals in enhancing energy security and raising Gulf electric systems' reliability and safety.

The Interconnection Project was implemented in three phases and consisted of the following principal elements: the interconnection of the Northern Systems in Kuwait, Saudi Arabia, Bahrain, and Qatar, completed in early 2009.

The second phase comprised the internal interconnection of the Southern Systems, including UAE and Oman, to form the UAE National Grid and the Oman Northern Grid, and the last phase, in 2010, interconnected the Northern and Southern Systems.

The Authority's CEO explained that the interconnection objectives include enhancing the security of electric power and achieving economic savings resulting from the possibility of each country benefiting from the reserves of other GCC countries to help reduce their stockpiles.

The benefits also extend to saving the cost of building new power stations, thus reducing operating and maintenance expenses, reducing carbon emissions, and activating and developing electric energy trading markets.