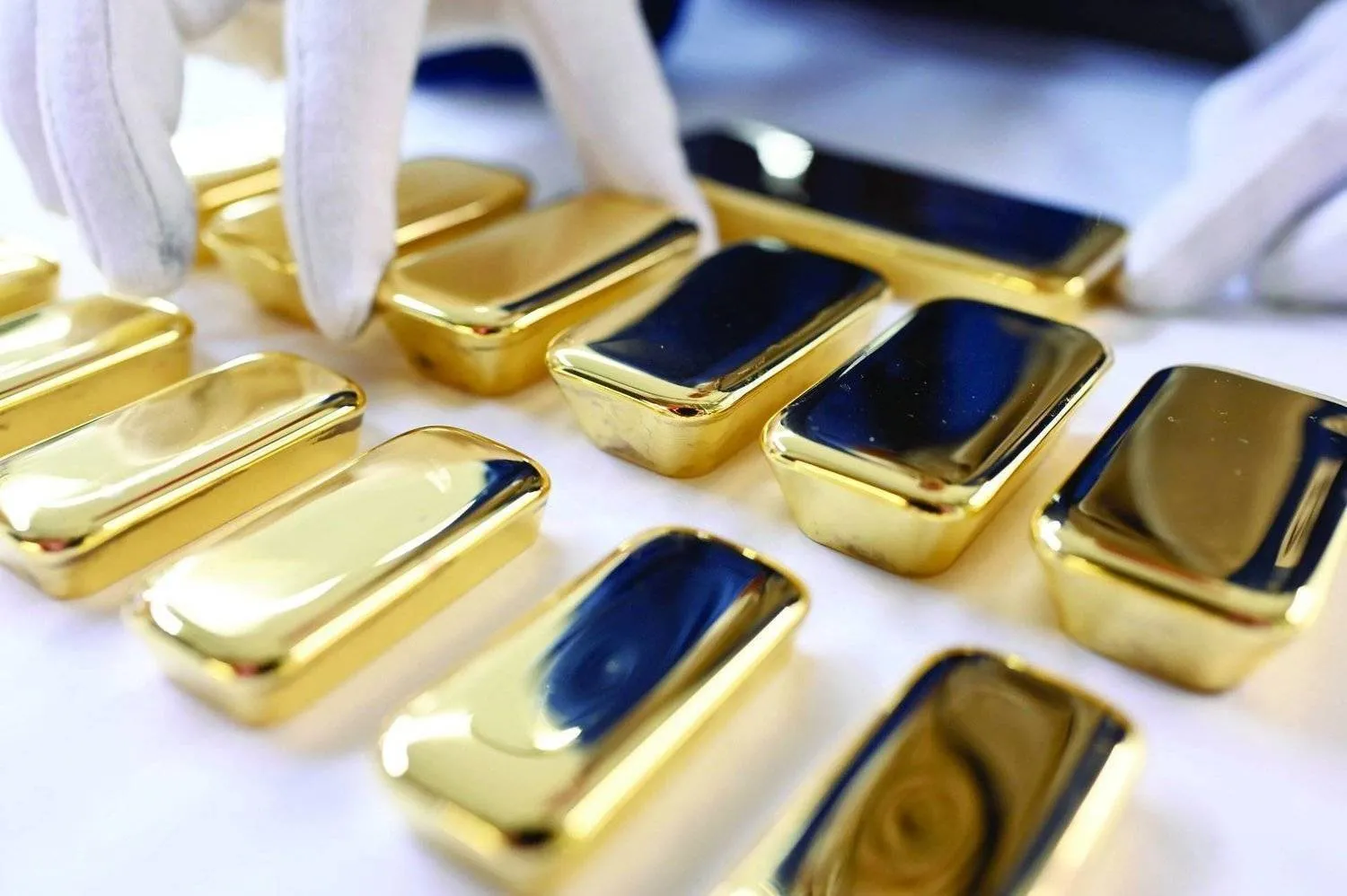

Prices of safe-haven gold climbed on Monday on heightened geopolitical tensions in the Middle East and amid expectations of a US rate cut in September, while focus shifted to the Federal Reserve's policy meeting due later this week.

Spot gold was up 0.3% at $2,391.80 per ounce, as of 0205 GMT. US gold futures firmed 0.4% to $2,390.50.

"Prices will hold a range ahead of the Fed meet and Chair Jerome Powell's comments. If we get a clearly dovish stance and softer jobs data, prices could head towards $2,450," said Kelvin Wong, OANDA's senior market analyst for Asia Pacific, according to Reuters.

The US central bank's Federal Open Market Committee meets on July 30-31 and is expected to keep rates unchanged at 5.25%-5.50%. However, softer US jobs data in June, cooling inflation and comments from top Fed officials have prompted the rate futures market to fully price in a 25 basis-point cut in September.

The ADP national employment report and non-farm payrolls report are the main data points due this week.

Gold, historically reputed for its stability as a favored hedge against geopolitical and economic risks, thrives in a low-interest rate environment.

Israel's security cabinet authorized Prime Minister Benjamin Netanyahu's government to decide on the "manner and timing" of a response to a rocket strike in the Israeli-occupied Golan Heights that killed 12 teenagers and children, and which Israel and the United States blamed on Lebanese armed group Hezbollah.

Bullion should see further safe-haven demand if things get more heated up in the Middle East, OANDA's Wong added.

Elsewhere, top consumer China's output of gold using domestic raw materials rose by 0.58% from the year before to 179.634 metric tons in the first half of 2024, the country's Gold Association said.

Spot silver gained 0.1% at $27.93 per ounce, platinum rose 0.8% to $942.75 and palladium was up 0.7% at $906.48.