The US Federal Reserve’s recent decision to cut interest rates marks a strategic move with immediate implications for Gulf economies. Because most regional currencies are pegged to the dollar, the rate cut functions as a direct stimulus, injecting liquidity, encouraging investment, and fueling growth across vital sectors from real estate to infrastructure, all while supporting long-term diversification strategies.

On Wednesday, the Federal Reserve lowered its benchmark rate by 25 basis points and signaled two further cuts before the end of the year. Central banks across the Gulf quickly followed, matching the US decision.

Five of the six Gulf Cooperation Council (GCC) states - Saudi Arabia, the UAE, Qatar, Bahrain, and Oman - maintain dollar pegs, while Kuwait’s dinar is linked to a basket of currencies.

Unlike the US, where inflation remains stubbornly above target, Gulf economies enjoy relatively low price growth. GCC data shows inflation averaged just 1.7 percent in 2024, compared with the Fed’s projection of 3 percent this year. This divergence allows Gulf policymakers to ease monetary conditions without stoking inflation, making the rate cut a tool to reinforce growth.

The most visible impact is on borrowing costs. When Gulf central banks reduce their benchmark rates, commercial banks quickly follow. Mortgage payments fall, encouraging home purchases and fueling demand in the property market. Developers benefit from cheaper financing, spurring new construction.

Personal and auto loans also become less costly, reducing household debt burdens and freeing up disposable income. For businesses, lower lending costs support expansion and investment, particularly in sectors tied to economic diversification.

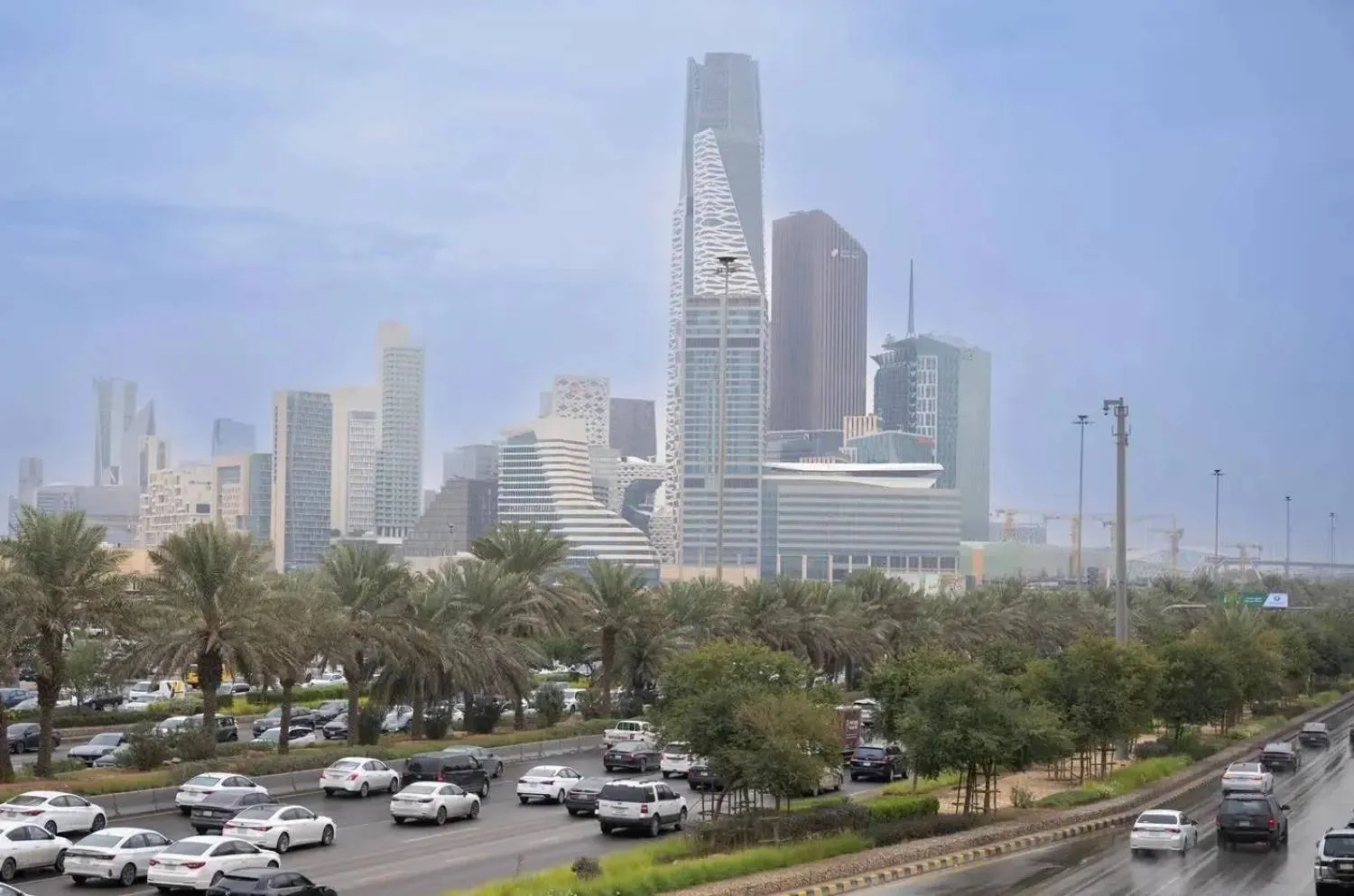

Meanwhile, falling returns on bank deposits prompt investors to shift capital into more productive assets, boosting overall liquidity. For governments, cheaper financing helps sustain major projects tied to national development plans, such as Saudi Arabia’s Vision 2030.

Sectoral effects are already apparent. Real estate is expected to benefit most, with cheaper mortgages increasing demand and pushing prices upward, while developers launch new projects. Banks may see pressure on their net interest margins, but stronger loan demand and improved asset quality could offset this. Retail, tourism, and entertainment sectors stand to gain as consumers increase spending. A weaker dollar, often associated with US rate cuts, may also boost demand for oil priced in dollars, providing further support to Gulf exporters.

The implications extend to debt markets. For new issuances, governments and companies can borrow more cheaply, while investors searching for higher returns are likely to increase demand for Gulf bonds and sukuk. This creates a favorable environment for funding large-scale diversification initiatives. Existing debt also gains value, as older securities with higher coupons become more attractive compared with new, lower-yielding ones. At the same time, issuers may opt to refinance older, more expensive debt with cheaper instruments, easing long-term debt burdens.

In short, the Fed’s rate cut is a “golden opportunity” for the Gulf. By lowering financing costs, boosting liquidity, and enhancing the appeal of local debt instruments, the move strengthens Gulf financial markets and accelerates the region’s broader push toward economic diversification.