The G20 Labor and Employment Ministers have stressed the importance of protecting jobs and acknowledged the value of technology and a human-centered approach including by using Behavioral Insights in employment policymaking.

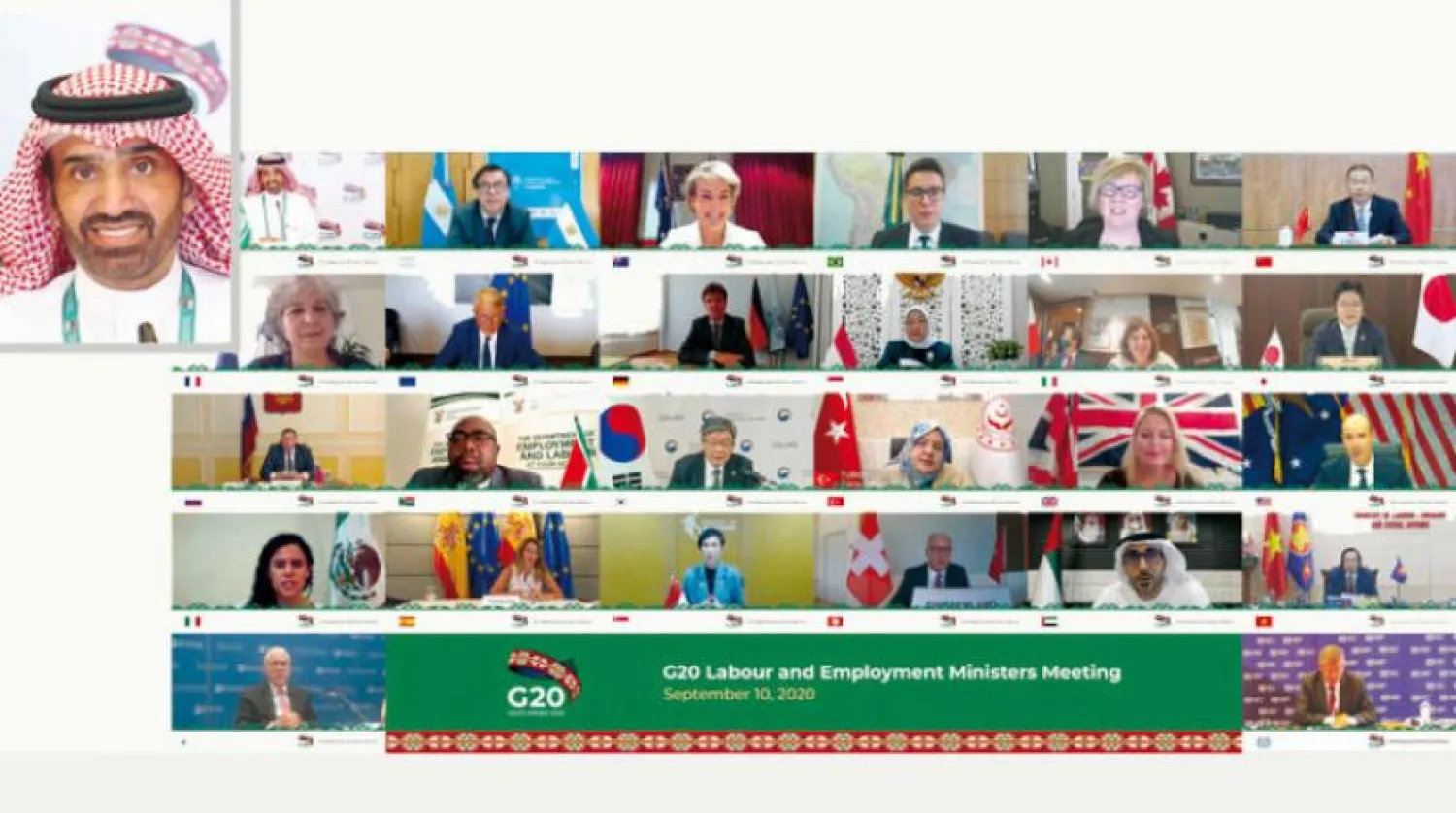

The Saudi Minister of Human Resources and Social Development, Eng. Ahmed Al Rajhi, said during the virtual meeting held by the ministers that “the COVID-19 crisis has created renewed impetus to safeguard labor markets and adopt social protection policies that secure people during and after crisis.”

“We are working with G20 countries to realize sustainable labor market recovery,” he told the meeting held under the G20 Saudi Presidency.

“This year, COVID-19 has brought an unprecedented global challenge with significant human costs. Fighting and overcoming the pandemic remains our highest and overriding priority,” said the ministers in their closing statement.

“We recognize the importance of protecting and promoting decent jobs for all, especially for women and youth, within our domestic and global labor markets.”

They stressed support for social protection systems to tackle gender inequalities.

The ministers also said they “acknowledge the value of bringing together technology and a human-centered approach including by using Behavioral Insights in employment policymaking.”