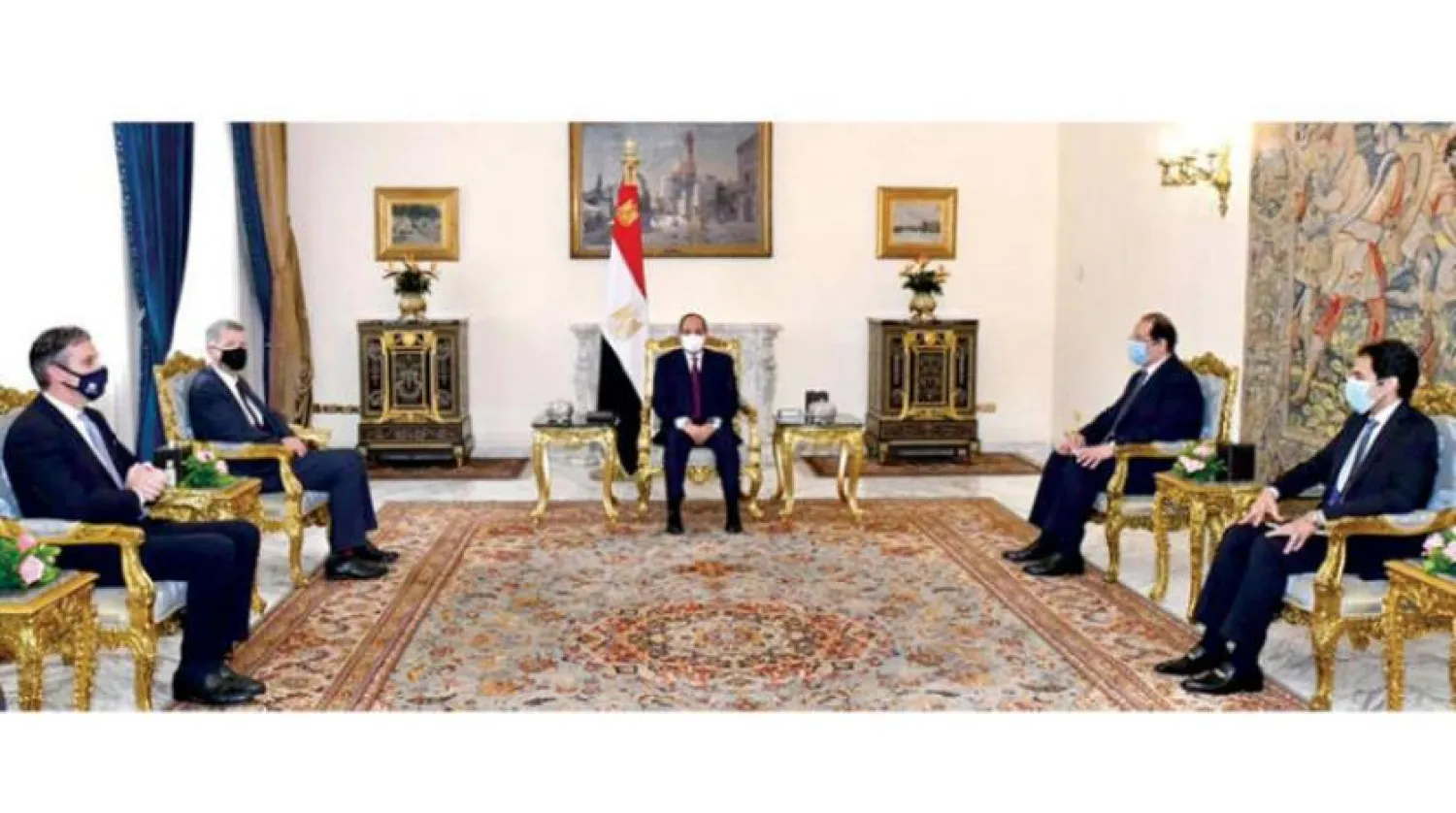

Egypt's President received on Monday Chief of the British Secret Intelligence Service (MI6) Richard Moore during which Abdul Fattah al-Sisi stressed the importance of boosting bilateral cooperation with the UK in various fields, primarily security and intelligence.

The meeting was also attended by Head of the Egyptian General Intelligence Services Abbas Kamel and the British Ambassador in Cairo.

Egyptian presidential spokesman Bassam Radi said that the meeting discussed ways to enhance bilateral security and intelligence cooperation on various related issues. Radi added that after welcoming Moore, Sisi asked him to convey greetings to Prime Minister Boris Johnson and stressed that Egypt has placed great importance on bilateral cooperation in various fields.

As extremism continues to spread regionally and globally, Sisi stressed that it is imperative that all countries unite to confront it. He recommended implementing a comprehensive approach that includes isolating extremist ideological mindset.

The president added that values such as moderation and dialogue must be upheld in parallel with strengthening and supporting development efforts and restoring the institutions in those countries suffering from crises in the region.

Both Sisi and Moore exchanged views on updates related to several regional issues of common interest. The meeting addressed tensions in the Eastern Mediterranean region, as well as the crisis in Libya.

Sisi briefed the UK official on Egypt’s vision regarding the Libyan crisis, stressing support to political solutions, respect for sovereignty and territorial integrity, and the need to abide by the ceasefire.

Moore conveyed to Sisi greetings from the British PM, saying his country is proud of its strong ties with Cairo.

He further praised Sisi’s efforts to consolidate regional security and stability, which has assured Egypt’s role as a center of stability within the region as a whole, especially in combating terrorism and illegal immigration.