Yemeni officials and the public hailed the new Saudi deposit agreement with the Central Bank of Yemen in Aden for $1 billion, indicating that it would improve the local currency rate, support primary food imports, and enable the government to implement economic reforms.

The deposit directly impacted the exchange rate, and Yemeni economists hope that the government would be able to utilize the funds appropriately and thoroughly.

After signing the deposit agreement, Yemeni activists lauded Saudi Arabia's role in supporting Yemen and recalled the dozens of projects and grants provided by the Kingdom, whereas Iran played a destructive role in the country.

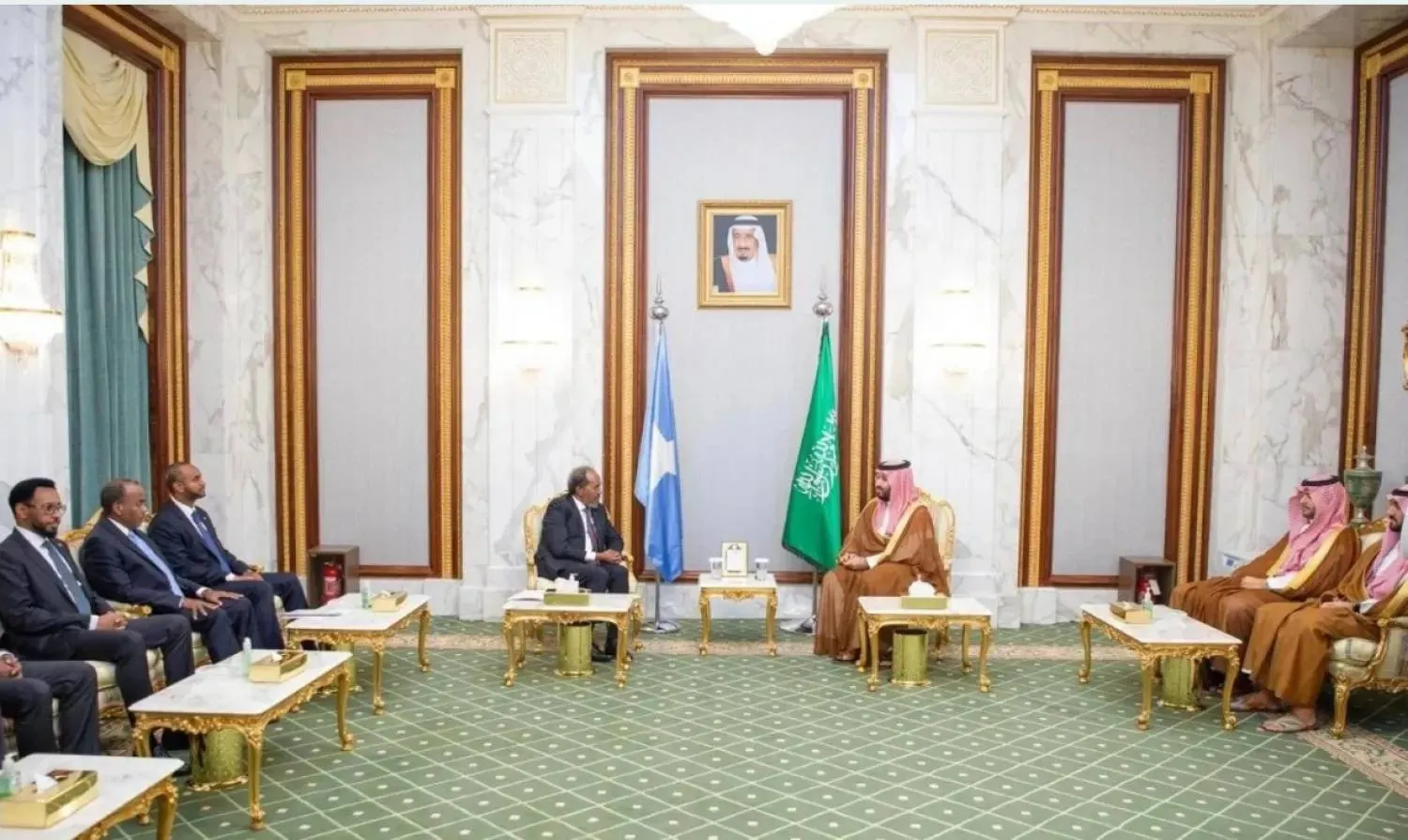

On Tuesday, Saudi Arabia announced the deposit per the directives of the Custodian of the Two Holy Mosques, King Salman bin Abdulaziz and Crown Prince Mohammed bin Salman.

The Saudi deposit extends the Kingdom's keenness and continuous support for Yemen regarding its economic development. It reflects the Kingdom's firm commitment to the Yemeni government and people.

It also supports the Yemeni government in carrying out its duties to restore the security and stability of Yemen.

According to the Saudi statement, the deposit would strengthen capabilities in implementing the economic reform program for Yemen with the Arab Monetary Fund as a technical body.

The program aims to develop a clear roadmap and a vision that takes care of the Yemeni people first and addresses their needs, in addition to strengthening efforts to build reserves at the Central Bank of Yemen to enable it to enhance economic stability.

The new Saudi deposit, in addition to the previous warranties, comes to a total of $4 billion since 2012, which help boost the Yemeni economy and protect it from collapse.

The head of the Yemeni Leadership Council, Rashad al-Alimi, said the deposit represented a solid boost for the Yemeni economy, the stability of the national currency, and the alleviation of the humanitarian crisis created by the Houthi militia.

Alimi expressed his gratitude and appreciation to Saudi Arabia under the leadership of King Salman bin Abdulaziz and his Crown Prince Mohammed, "who set an example of solidarity and support for our Yemeni people, leading to the signing of the facilitation of the generous Saudi deposit to the Central Bank of Yemen today, which is estimated at one billion dollars."

He tweeted, "Kingdom of Saudi Arabia, over the years of the unjust war erupted by the Houthi terrorist militia backed by the Iranian regime, affirms with its leadership, government, and people their responsible vision towards Yemen."

They affirm defending Yemen's national and Arab identity, supporting its economy, and alleviating the suffering of its people without discrimination in all parts of the country, he asserted.

The official praised both sides' joint efforts, which resulted in this important agreement to support the Yemeni economy and stabilize the national currency within a path full of promising cooperation, including development and reconstruction programs and many strategic service projects.

Saudi Arabia is Yemen's number one donor supporting the country with deposits, fuel subsidies, and humanitarian and development aid that have amounted to about $20 billion in recent years.

Meanwhile, Yemeni economist Abdulhameed al-Masajdi noted that the new deposit comes at perfect timing amid a challenging and complex economic situation.

Masajdi described the fund as "a glimmer of hope" for the recovery of the national currency and compensation for government revenues from oil sales, which stopped about four months ago after the Houthi militia attacked oil export ports in the liberated areas.

Masajdi told Asharq Al-Awsat that before the deposit announcement, the currency was sharply dropping, prices were soaring high as the government soon won't be able to pay employees' salaries, and the faltering international and regional efforts to renew and expand the ceasefire.

He stressed that the new deposit will help with economic difficulties and support the government to continue carrying out its obligations towards citizens, noting that the exchange rate improved amid expectations of further improvement during the coming days.

The expert explained that the Yemeni government depended on this deposit as a "savior" in light of these challenges.

He highlighted the importance of completing the necessary economic reforms, activating all monetary policy tools, combating corruption, and enhancing governance transparency, values, and standards.