President Donald Trump expressed frustration with US-Japan trade negotiations on Monday as Treasury Secretary Scott Bessent warned that countries could be notified of sharply higher tariffs as a July 9 deadline approaches despite good-faith negotiations.

Trump wrote in a social media post that Japan's reluctance to import American-grown rice was a sign that countries have become "spoiled with respect to the United States of America."

"I have great respect for Japan, they won't take our RICE, and yet they have a massive rice shortage," Trump wrote on Truth Social. "We'll just be sending them a letter, and we love having them as a Trading Partner for many years to come."

Trump said last week that his administration would send letters to a number of countries notifying them of their higher tariff rates before July 9, when tariff rates are scheduled to revert from a temporary 10% level to his suspended rates of 11% to 50% announced on April 2.

Trump's Monday complaint about US-Japan rice trade follows his comments broadcast on Sunday that Japan engages in "unfair" autos trade with the US.

White House spokesperson Karoline Leavitt said on Monday that Trump would meet with his trade team to set tariff rates for countries "if they don't come to the table to negotiate in good faith."

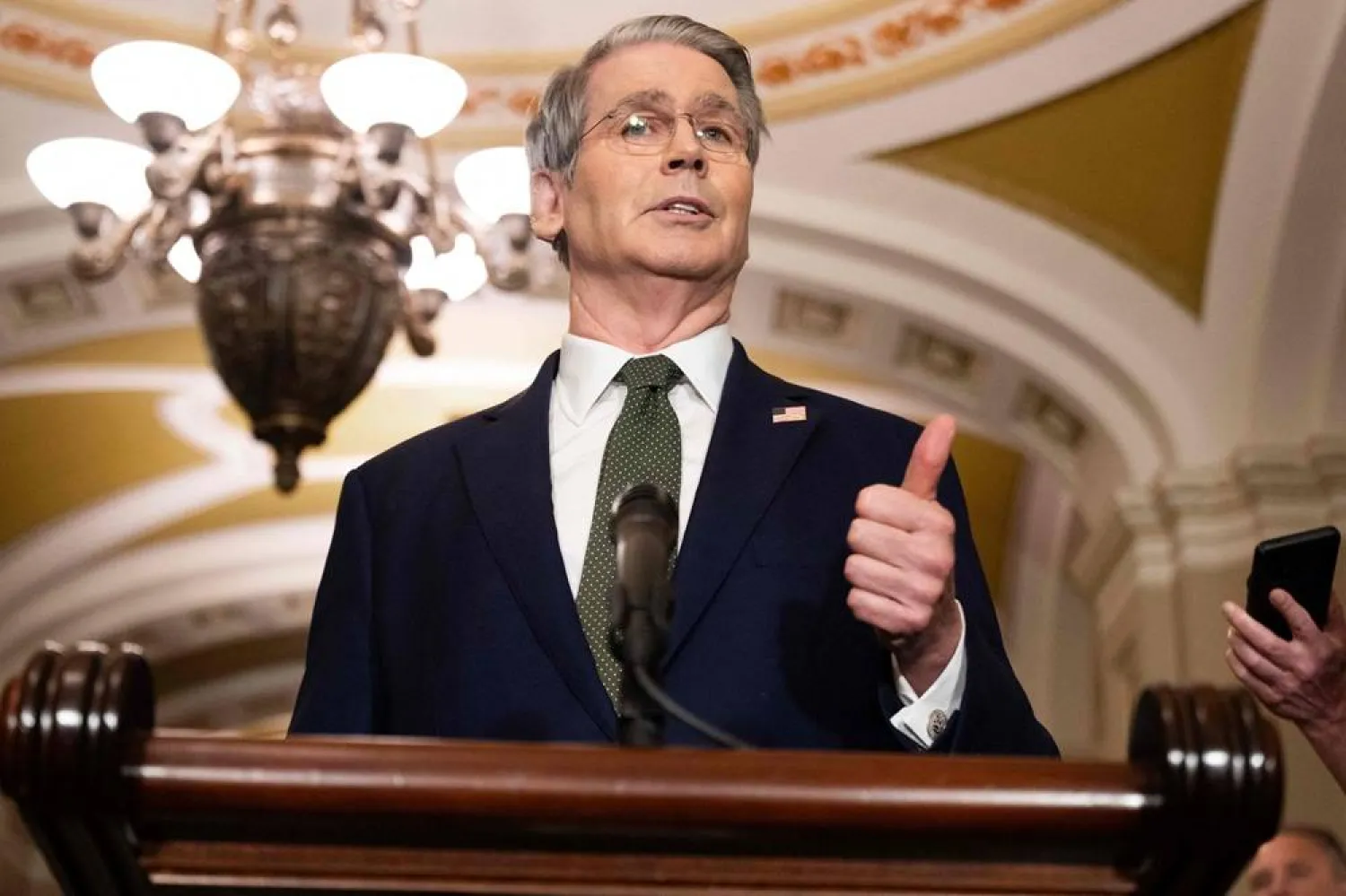

Bessent, who earlier this month floated the idea of extending the deadline for countries that were negotiating trade deals with the US in good faith, told Bloomberg Television that only Trump would decide on such extensions. He added that he expects "a flurry" of deals ahead of the July 9 deadline and wanted to keep up pressure on trading partners.

"We have countries that are negotiating in good faith, but they should be aware that if we can't get across the line because they are being recalcitrant, then we could spring back to the April 2 levels. I hope that won't have to happen," Bessent said.

Japan's main tariff negotiator, Ryosei Akazawa, on Monday said that Japan would continue working with the US to reach a trade agreement while defending Japan's national interest.

Akazawa said he was aware of Trump's comments on autos, adding that a continuation of Trump's 25% on autos imported from Japan would cause significant damage to its economy.

Another key trading partner, the European Union, is open to a trade agreement that maintains a 10% US tariff on EU goods, but wants US commitments to reduce its tariffs in key sectors such as pharmaceuticals, semiconductors and commercial aircraft, Bloomberg News reported, citing people familiar with the matter.

Reuters reported earlier this month that European officials are increasingly resigned to a 10% rate of "reciprocal" tariffs being the baseline in any trade deal between the US and the EU. Britain negotiated a trade deal on similar terms, accepting a 10% US tariff on many goods, including autos, in exchange for special access for aircraft engines and British beef.