US President Donald Trump's administration is prepared to raise tariffs on China if Beijing continues blocking rare earth exports, Treasury Secretary Scott Bessent warned Sunday.

China announced Thursday it would suspend for one year the restrictions it imposed in October on rare earth materials and technologies, but Bessent voiced concern that Beijing had not always followed through on its commitments.

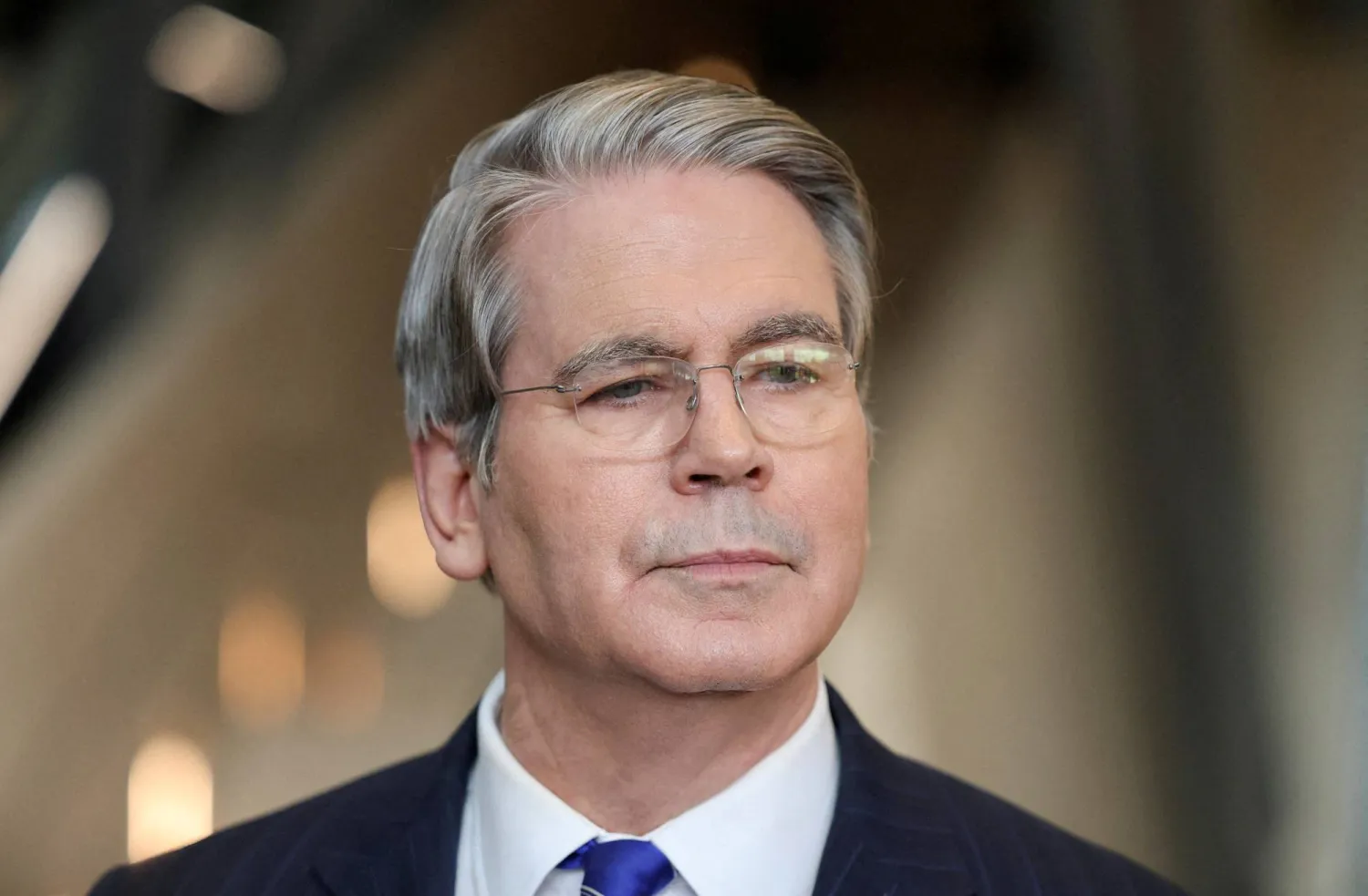

"The Chinese have cornered the market (on rare earths), and unfortunately at times they proved to be unreliable partners," Bessent told Fox News Sunday.

Such metals are mined in several countries including the United States, but China has a virtual monopoly on processing these metals for industry usability.

The suspension was announced following recent talks between Trump and his Chinese counterpart Xi Jinping in South Korea.

Some of the export restrictions previously decided by Beijing remain in place.

Following the agreement and the "goodwill" between the leaders of the world's two largest economies, Bessent said he hoped "we can depend on them to be more reliable partners."

If not, "we could threaten the tariffs again," Bessent warned, stressing Washington has been prepared to use "maximum leverage."

"We don't want to decouple with China, but we're going to have to de-risk," he said.

Bessent also accused previous US governments of being "asleep at the switch" as Beijing spent years putting together its rare earths strategy.

"Now this administration, we're going to go at warp speed over the next one, two years, and we're going to get out from under this sword that the Chinese have over us -- and they have it over the whole world," he told CNN's "State of the Union" talk show.

As part of the announced deal, Washington will reduce the level of tariffs imposed on Chinese exports to the United States by 10 percent.

The agreement also requires China to take significant measures to stem the flow of fentanyl into the United States, where consumption of the powerful synthetic opioid has caused tens of thousands of deaths.

According to the US Drug Enforcement Administration, China is by far the largest supplier of fentanyl to the United States.