Marks & Spencer is revamping its supply chain from "factory to floor,” the retailer's new fashion boss told Reuters, as it looks to double annual online non-food sales to nearly 3 billion pounds ($4 billion).

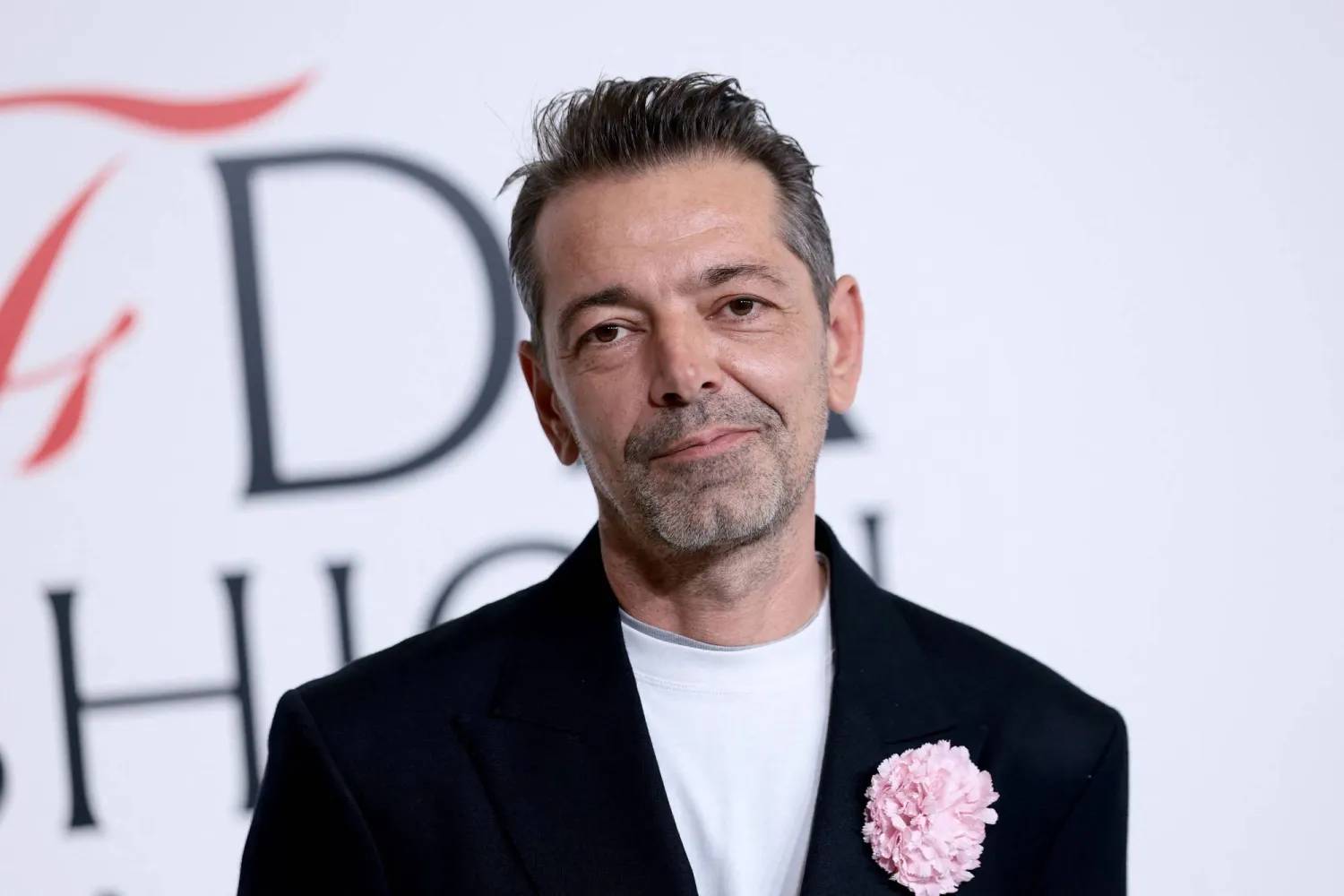

John Lyttle, who joined M&S as managing director fashion, home and beauty (FH&B) in March, said the 141-year-old retailer has regained its footing after a cyberattack in April paralyzed online sales and cost about 300 million pounds in lost profit.

He said M&S had done a good job re-establishing its value, quality and style credentials, with FH&B sales up 9% over three years and market share rising to 10.5% in 2024/25, from 9.1% in 2021/22.

It now needs to focus on becoming a truly omnichannel retailer, said Lyttle, in his first interview since joining M&S.

"So from where we make our goods, to how we flow that all the way into our warehouses, how our warehouses operate, and then how we feed those products out to our customers - whether that's online, whether that's in our stores," he said.

Simplifying and cutting supply chain costs has been a priority for many companies after COVID-19, war in Ukraine, Red Sea shipping disruption and broader global trade upheavals, most recently due to US tariffs.

MORE LONG-TERM PARTNERSHIPS WITH SUPPLIERS

M&S, which mainly sources products from China, Bangladesh, India, Pakistan, Vietnam, Cambodia, Sri Lanka and Turkey, wants to create more long-term partnerships to reduce the risks to supplies.

While progress has been made in recent years through consolidating suppliers, M&S has "much more opportunity to go after through resetting how we buy, unlocking more margin from our scale, increasing cost discipline and reducing complexity," said Lyttle.

The cyber hack knocked what had been a strong turnaround under Stuart Machin, CEO since 2022, with M&S' 2024/25 profit its highest in over 15 years and its stock at near-decade highs.

Dominic Younger, fund manager at Columbia Threadneedle Investments, one of M&S' top 10 investors, said it had made huge and hard-won strides in fixing the FH&B front-end.

"But one of the most exciting aspects from an investment point of view is that, together with continuing to drive the food division, there is so much opportunity out there in terms of modernising the clothing supply chain," he said.

With a clothing customer base of 21 million, Lyttle said overhauling M&S' supply chain can double FH&B's online sales over the long term from about 1.4 billion pounds in 2024/25, while lifting its online operating margin to double digits.

M&S is also aiming to increase online's share of total FH&B sales from about 34% to 50% in the medium term, said Lyttle, a former Boohoo CEO who was also an executive at Primark.

"If you look at our online sales participation today versus the market, we're about 10 (percentage) points behind," said Lyttle, noting M&S was even further behind some top competitors, such as Next.

Next, an early adopter of warehouse and distribution automation, makes about 59% of its UK sales online.

M&S can increase online sales by optimising the breadth and depth of its product range, encouraging more customers to use its more than 1,000 stores for 'click and collect' and returns, and utilising more channels such as lockers, Lyttle said.

It will also introduce more payment methods and relaunch its 'Sparks' loyalty programme to drive more frequent purchases.

INVESTMENT IN AUTOMATION

Part of M&S' plan is a 120 million pound three-year investment in automation to increase capacity, reduce complexity and deliver cost savings worth "multi-millions" of pounds.

M&S is spending 600 million to 650 million pounds on capital investment in 2025/26 of which between 200 million and 250 million is being invested in technology infrastructure, store maintenance and upgrades to its logistics fleet.

In its vast Castle Donington warehouse in central England, M&S is investing in robotic technology that will speed up sorting 'click and collect' parcels and extend cut-off times for next-day delivery to nearly midnight.

Further investment at the 900,000-square foot site and another in Bradford, northern England, will increase boxed storage capacity by more than 30%.

M&S is also accelerating the implementation of a new planning platform, with a new merchandising capability already delivered, automating what was previously largely a manual task.

Cost savings will not need to come at the expense of the 63,000-strong M&S workforce, Lyttle said, adding: "Growing our business means we're moving more product, therefore we need more people to help us do that".

CYBER HACK LESSONS

While the cyber hack, which forced M&S to revert to manual processes, had not changed its strategy or longer-term plans, important lessons had been learned, Lyttle said.

"It's not just lessons of the actual incident. It's just general things that we could have done better, or we could have done faster," he said, without giving away any specifics.

"You don't want people who impacted us at the beginning to understand in any way," he added.