China's push to develop top-end artificial intelligence microchips is gaining momentum, but analysts say it will struggle to match the technical might of US powerhouse Nvidia within the current decade.

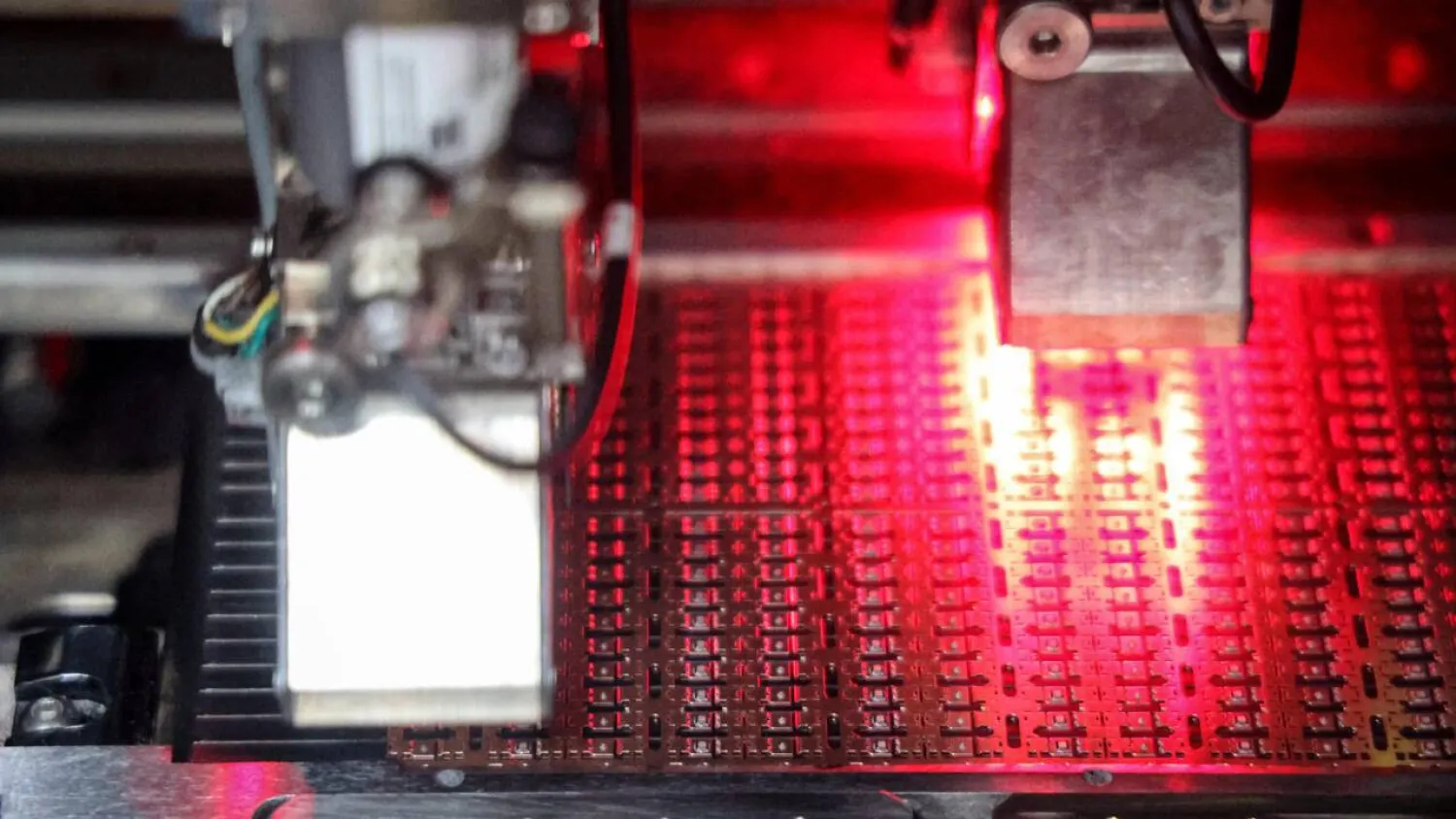

Ramping up its chip industry is a way for Beijing to beat restrictions imposed by Washington on exports of the most advanced chips -- used to power AI systems -- to China.

The United States cites national security concerns, such as the risk of giving China a military advantage, for the block, a geopolitical bind that shows no sign of easing.

"China wants chips that policy cannot take away," said Stephen Wu, a former AI software engineer and founder of the Carthage Capital investment fund.

However, "full end-to-end parity with Nvidia's best chips, memory packaging, networking and software is not guaranteed" by 2030 or even beyond, Wu told AFP.

Announcements of computing upgrades by Chinese companies and reports of plans to dramatically increase output of advanced semiconductors have driven up chip-related shares in the country.

But to catch up with Nvidia, China needs to make fast progress on high-bandwidth memory and packaging -- "the hardest and most complex parts of the chip", Wu said.

Other challenges include building the right software to harness the chips' power, and upgrading manufacturing tools.

"These chips are extremely advanced and tiny, so imagine carving a stone sculpture with a hammer instead of a chisel," Wu said.

'Only way' to succeed

"The industry consensus is China at least needs five to ten years to catch up," said George Chen of The Asia Group, a view reflected by Dilin Wu, research strategist at Pepperstone.

"The future is bright, but not yet," she told AFP.

"It's maybe a 2030 story", as "significant gaps remain in terms of performance, and also in terms of energy efficiency and ecosystem maturity".

Public demand for AI services is booming in China, and while government support for new chips is "substantial", the investment required is "immense", she added.

Shares in Alibaba, the e-commerce titan ploughing billions of dollars into AI tech, have more than doubled since January.

And Chinese chip industry leader Huawei will reportedly double output of its top Ascend 910C chip in the next year.

The hype has also sharply driven up stocks in the smaller chipmaker Cambricon, sometimes dubbed "China's Nvidia".

"I think this rally can be sustained", partly because it is driven by Chinese government policy, Pepperstone's Wu said.

Even Xiaomi, whose 2014 venture into chip design was a self-confessed flop, is turning back to semiconductors.

"Chips are the only way for Xiaomi to succeed," the company's CEO Lei Jun said in Beijing last month, referring to the production of high-end smartphone chips.

'Best in China'

China, the world's biggest consumer of semiconductors, is a huge market for California-based Nvidia.

Nvidia chips are still "the best... to train large language models", the systems behind generative AI, said Chen Cheng, general manager for AI translation software at tech firm iFLYTEK.

Faced with US restrictions, "we overcame that difficulty" by shifting to Chinese-made tech, she said in a group interview.

"Now our model is trained on Huawei chips" -- currently the best in China, Cheng said.

Meanwhile Nvidia, the world's largest company by market capitalization, is under pressure from both sides.

The Financial Times reported last month that Beijing had barred major Chinese firms from buying a state-of-the-art Nvidia processor made especially for the country.

And the company must now pay the US government 15 percent of revenue from certain AI chip sales in China.

Nvidia boss Jensen Huang has warned that restrictions on exporting his most cutting-edge semiconductors to China will only fuel the country's rise.

"They're nanoseconds behind us," the leather jacket-clad Huang said on a tech business podcast.

"So we've got to go compete."