Saudi-listed ACWA Power, the world's largest private water desalination company, announced in a press release on Wednesday the completion of a Sale and Purchase Agreement to sell 35% of its shareholding in ACWA Power Bash Wind Project Holding Company Limited and ACWA Power Uzbekistan Wind Project Holding Company Limited to China Southern Power Grid International (HK) Co. Ltd (CSGIHK), the global investment and development arm of China Southern Power Grid (CSG).

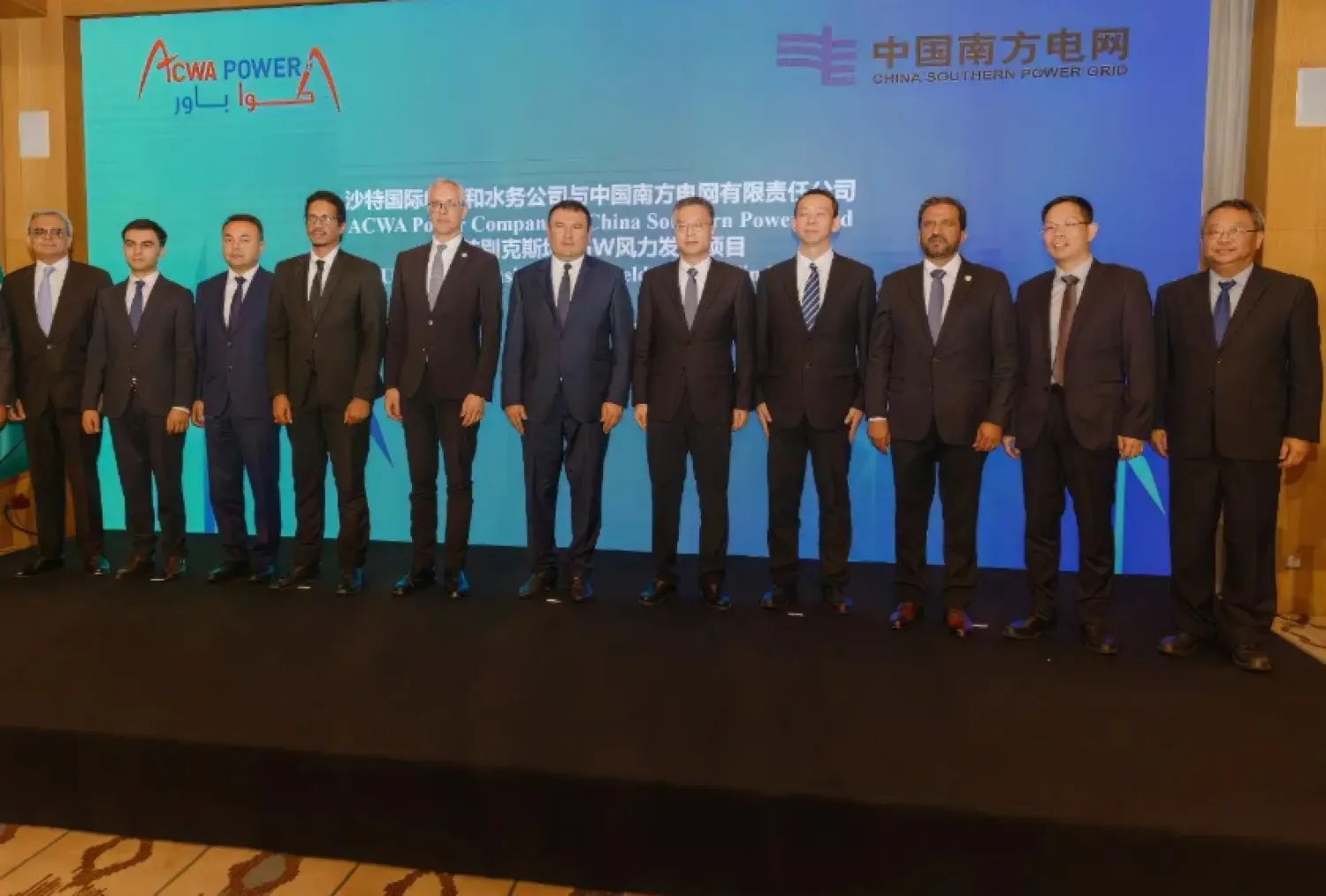

Following the successful completion of the conditions precedent, a closing ceremony was held in Tashkent to mark the transaction's completion, SPA reported.

The transaction represents the first co-investment transaction between ACWA Power and China Southern Power Grid for a large-scale renewable energy project in Central Asia. This milestone follows framework agreements signed in December 2022 between ACWA Power and Chinese companies that lay the ground for financing, investment, and construction of ACWA Power's global clean and renewable energy projects in Saudi Arabia and Belt and Road Initiative countries.

ACWA Power's CEO expressed enthusiasm about the collaboration, emphasizing the importance of international cooperation in delivering sustainable solutions.

"Through strategic collaboration with China Southern Power Grid International, we are proud to announce a significant milestone in our journey towards sustainable energy solutions. The agreement in relation to our Bash and Dzhankeldy wind projects in Uzbekistan not only enhances ACWA Power's global presence but also strengthens ties between two industry leaders from different regions. This historic partnership underlines our commitment to driving innovation and progress in the renewable energy sector," he said.

The ACWA Power Bash Wind Project Holding Company Limited and ACWA Power Uzbekistan Wind Project Holding Company Limited hold 100% stakes in ACWA Power Bash Wind LLC ("Bash") and ACWA Power Dzhankeldy LLC ("Dzhankeldy"), respectively, representing a combined 1GW of capacity with an investment cost of over USD 1.3 billion.

Upon completion, the Bash and Dzhankeldy wind power plants are set to become some of Central Asia's largest renewable energy projects. Uzbekistan is ACWA Power's second-largest market in terms of investment cost, underscoring the company's long-standing commitment to the country, the release said.