Chinese leaders pledged on Thursday to deploy "necessary fiscal spending" to meet this year's economic growth target of roughly 5%, acknowledging new problems and raising market expectations for fresh stimulus on top of measures announced this week.

The remarks, which included guidance to the government to support household consumption and stabilize the troubled real estate market, came in an official readout of a monthly meeting of top Communist Party officials, the Politburo. The September meeting is not usually a forum for macroeconomic discussions, which suggests growing anxiety over slowing growth momentum.

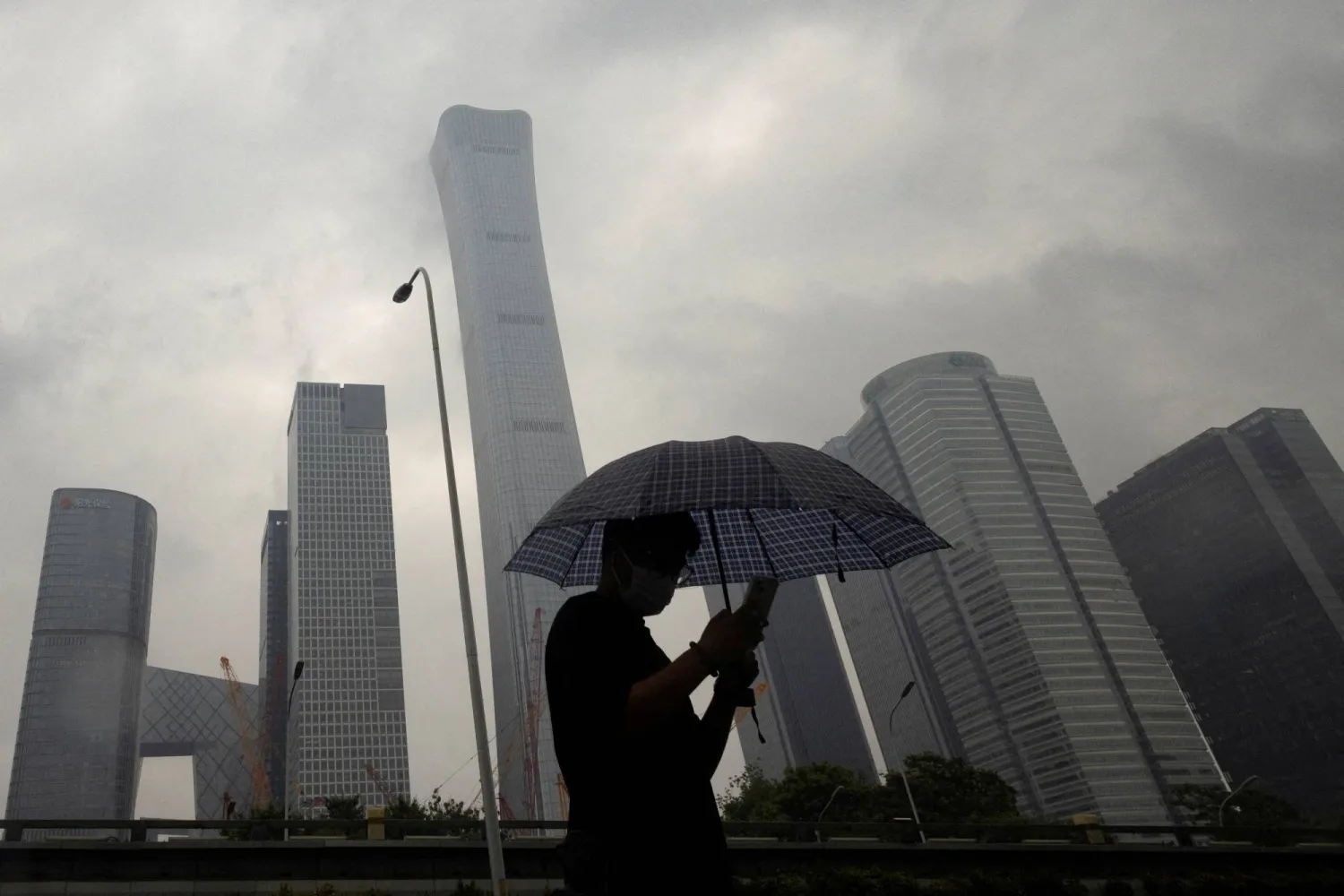

The world's second-largest economy faces strong deflationary pressures due to a sharp property market downturn and frail consumer confidence, which has exposed its over-reliance on exports in an increasingly tense global trade environment.

A wide range of economic data in recent months has missed forecasts, raising concerns among economists that the growth target was at risk and that a longer-term structural slowdown could be in play.

"New situations and problems" demand a sense of "responsibility and urgency," state media reported, citing the Politburo meeting.

China's central bank on Tuesday unveiled its most aggressive monetary easing since the pandemic, flagging cuts to a broad range of interest rates and a 1 trillion yuan ($140 billion) liquidity injection into the financial system, among other steps.

Beijing is considering pumping up to 1 trillion yuan into its biggest state banks to increase their capacity to support the struggling economy, primarily by issuing new special sovereign bonds, Bloomberg News reported on Thursday.

Chinese real estate shares jumped more than 8% and their Hong Kong peers soared 9% after the Politburo announcement, leading broader gains in the stock market. The yuan and Chinese bond yields also rose.

The Politburo said the government should "promote the stabilization of the real estate market", expand a whitelist of housing projects that can receive further financing and revitalize idle land, according to the readout.

Officials "will respond to people's concerns, adjust home purchase restriction policies, lower existing mortgage rates and improve land, fiscal, tax and financial policies as soon as possible to push forward the new model of property development", it said.

The Politburo's endorsement of further stimulus "represents a strategic shift in macro policy, from piecemeal policies to a highly orchestrated package in the right direction," said Bruce Pang, chief economist China at Jones Lang LaSalle.

"A pick-up in government spending will probably be sufficient to drive a turnaround in business confidence, market sentiment and economic activities, helping China to catch up with potential trend growth."

China will make good use of its ultra-long special sovereign bonds and local government special bonds to support government investment, the Politburo vowed, according to Reuters. It pledged to boost income for low- and middle-income groups and support consumption as well as improve childbirth support policies.

The ministries of finance and civil affairs said on Wednesday they would distribute a one-time allowance to disadvantaged people ahead of a national holiday in early October. They vowed to prioritize employment and promote wage growth in response to steep pay cuts in some sectors and soaring youth unemployment.

"Falling inflation and private sector deleveraging mean that rate cuts alone won't dramatically boost domestic demand," said Capital Economics analyst Julian Evans-Pritchard. "Doing so would require more substantial fiscal support. There are some hints of that in the (Politburo) communique."

As flagged by central bank Governor Pan Gongsheng on Tuesday, top policymakers said China would lower the reserve requirement ratio and implement "forceful" interest rate cuts.