The United States and China reached a framework agreement to switch short-video app TikTok to US-controlled ownership that will be confirmed in a call between President Donald Trump and Chinese President Xi Jinping on Friday, US officials said on Monday.

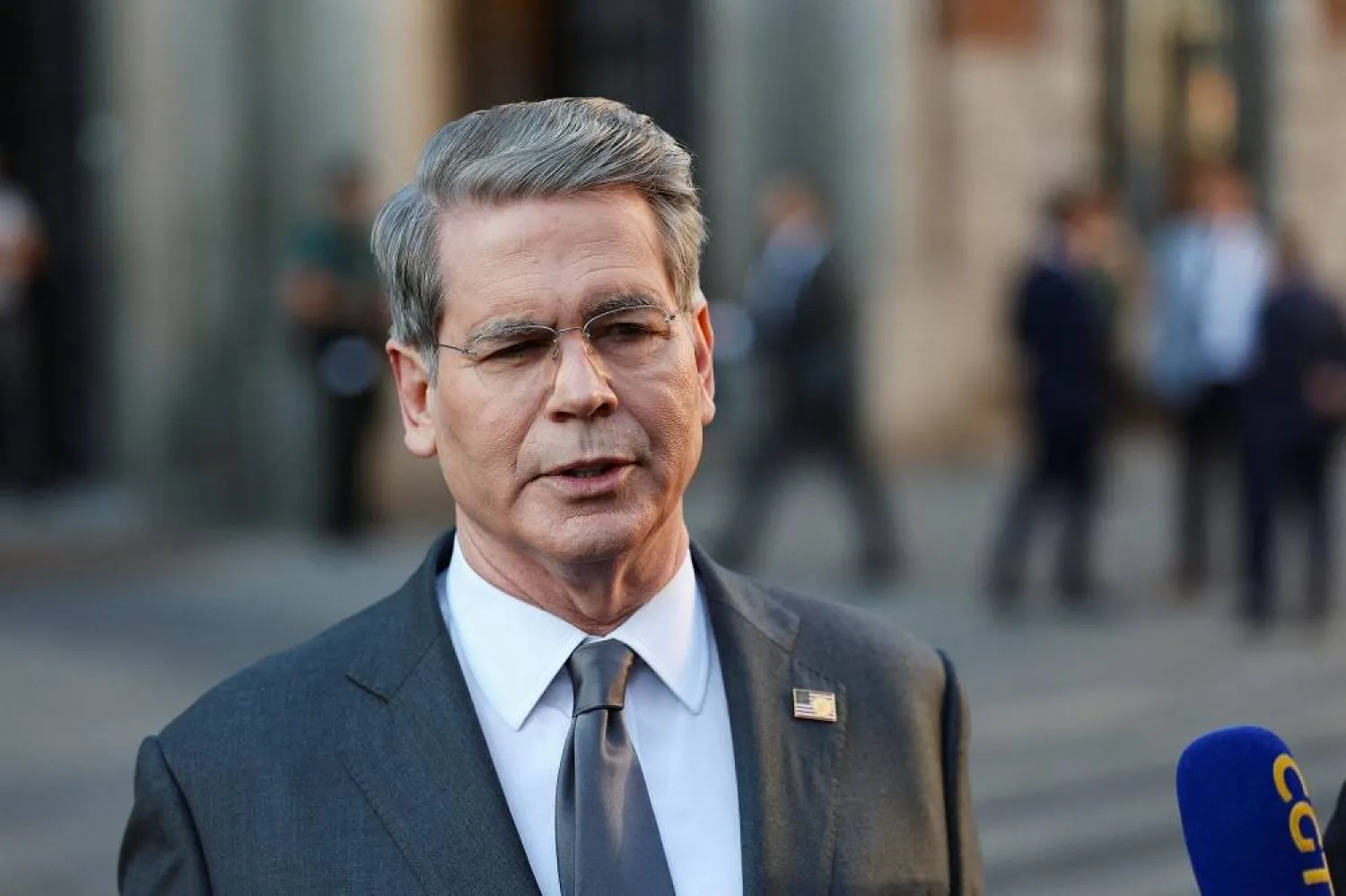

US Treasury Secretary Scott Bessent said a Wednesday deadline that could have switched off the popular social media app in the US encouraged Chinese negotiators to reach a potential deal. He said that deadline could be extended by 90 days to allow the deal to be finalized. He declined to discuss specifics of the deal.

Bessent said when commercial terms of the deal are revealed, it will preserve aspects of TikTok that Chinese negotiators care about, including its "Chinese characteristics."

"They're interested in Chinese characteristics of the app, which they think are soft power. We don't care about Chinese characteristics. We care about national security," Bessent told reporters at the conclusion of two days of talks in Madrid.

It is the second time this year that the two sides have said they were nearing a TikTok deal. The earlier announcement in March ultimately did not pan out.

Any agreement could require approval by the Republican-controlled Congress, which passed a law in 2024 requiring divestiture due to fears that TikTok's US user data could be accessed by the Chinese government, allowing Beijing to spy on Americans or conduct influence operations through the app.

But the Trump administration has repeatedly declined to force a shutdown, which could anger the app's millions of users and disrupt political communications, including those of the White House. It is not clear whether parent company ByteDance would transfer control of the app's underlying technology to the unnamed US buyer.

Trump praised the TikTok deal on Monday.

"The big Trade Meeting in Europe between The United States of America, and China, has gone VERY WELL! It will be concluding shortly," Trump wrote on his Truth Social platform. "A deal was also reached on a ‘certain’ company that young people in our Country very much wanted to save. They will be very happy! I will be speaking to President Xi on Friday. The relationship remains a very strong one!!!"

The US-China negotiations at the Spanish foreign ministry's baroque Palacio de Santa Cruz were the fourth round of talks in four months to address strained trade ties as well as TikTok’s looming divestiture deadline.

Delegations led by Bessent and Chinese Vice Premier He Lifeng have met in European cities since May to try to resolve a trade war that has seen tit-for-tat tariff hikes and a halt in the flow of rare earths to the United States.

US Trade Representative Jamieson Greer, who was also part of the US delegation in Madrid, said the TikTok deal was an indication of good faith between the two sides.

"It's no secret that there are serious issues on trade, economics, and national security between the United States and China. To be able to come, sit down, quickly identify the issues, narrow them down to a very granular spot, and be able to come to a conclusion, subject to the leaders’ approval, I mean, that is remarkable," Greer said.

TRUMP, XI TO DISCUSS MEETING

Bessent said talks on other issues would continue, probably in the coming weeks. Trump has repeatedly expressed interest in a meeting with Xi, and China is trying to woo Trump to Beijing for a summit.

Bessent said it was up to the leaders to discuss whether to meet during Friday's call.

Earlier on Monday a US official with knowledge of the negotiations had said that the US would press ahead with a ban on TikTok if China didn't drop its demands for reduced tariffs and technological restrictions as part of a divestiture deal.

Speaking to reporters, Bessent and Greer said China wanted concessions on trade and technology in exchange for agreeing to divest from the popular social media app.

"Our Chinese counterparts have come with a very aggressive ask," Bessent said, adding: "We are not willing to sacrifice national security for a social media app."

The talks took place as Washington demands that its allies place tariffs on imports from China over Chinese purchases of Russian oil, which Beijing on Monday said was an attempt at coercion.

Bessent said the issue of Russia was briefly discussed.

Beijing separately announced on Monday that a preliminary investigation of Nvidia had found the US chip giant had violated its anti-monopoly law. Bessent said the announcement on Nvidia was poor timing.

The probe is widely seen as a retaliatory shot against Washington's curbs on the Chinese chip sector.