JCPenney said Thursday it plans to spend more than $1 billion by the end of 2025 in a bid to revive the storied but troubled 121-year-old department store chain.

The money is going toward remodeling JCPenney stores, upgrading its online shopping site and app, and making its supply network more efficient so that online orders are delivered more quickly.

JCPenney’s CEO Marc Rosen, who took the company’s helm in November 2021 and has served as an executive at Levi Strauss and Walmart, is renewing the chain’s focus on its core middle-income shoppers with affordable fashion and housewares.

“Now is the time more than ever to lean into that and make sure that we’re delivering that experience for our customer,” Rosen said in an interview with The Associated Press. That’s a change of tactics from previous management teams that pursued wealthier shoppers with offers of trendy items and major appliances.

As part of the plans unveiled Thursday, check-out stations that had been located throughout JCPenney's stores will be replaced with a single area of cashiers. Shoppers will also see brighter lighting and a fresh coat of paint. Store employees will be equipped with mobile devices to scan inventory and ring up shoppers' purchases. And the chain is making upgrades to its Wi-Fi networks to speed up in-store connections.

But JCPenney is playing catch-up with its competitors — from discounters to department stores like Macy’s and Walmart — that have been upgrading their stores and online businesses, underscoring the challenges faced by the retailer based in Plano, Texas.

JCPenney, which emerged from Chapter 11 reorganization in December 2020 with new owners, not only has grappled with years of internal issues but also faces an uncertain economy that has challenged healthier department stores.

The chain's core customers are budget-conscious families, whose median income ranges from $50,000 to $75,000. They've been particularly hit hard by higher costs of basic items and high interest rates, making borrowing on credit cards and taking out a mortgage more expensive.

Rosen said JCPenney's customers are spending $700 more per month than two years ago just for basic necessities, like rent, gas and food. He noted they're seeking competitive prices as well as a good shopping experience.

But in this tough economy, JCPenney has a role, Rosen said. He believes shoppers are finding other department stores too expensive, while online retailers and off-price stores don't give them the customer service JCPenney shoppers are looking for.

The company filed for bankruptcy reorganization in May 2020 after the pandemic-induced temporary closing of stores put the already struggling retailer deeper in peril.

Under new owners — mall companies Simon Property Group Inc. and Brookfield Property Partners LP — JCPenney shuttered nearly a quarter of its 850 stores. It now has roughly 650 stores. It has less than $500 million in debt, down from nearly $5 billion at the time of its bankruptcy filing, Rosen said.

As part of the latest remodeling push, Rosen said 100 stores have been refurbished. The plan is to remodel anywhere from 50 to 100 per year, he said.

The retailer has been rebuilding its beauty business after Sephora announced a deal to leave the chain for rival Kohl's three years ago. As part of its overhaul, it has been highlighting beauty products that cover a wider range of skin tones. One third of its customers are of color.

The retailer launched new store label brands like Mutual Weave men’s clothing and reintroduced some national brands like Adidas. It launched national labels such as Forever 21, owned by Authentic Brands Group LLC, which has a minority stake in JCPenney. It also teamed up with celebrity stylist Jason Bolden to recreate collections for two of its store label brands, J. Ferrar and Worthington, a long-time brand it brought back.

Most importantly, Rosen said JCPenney has worked hard to keep the basics like jeans, white-T-shirts, and sheet sets in stock with the full size range or full color assortment, a problem that has plagued the chain and frustrated shoppers.

Rosen said the changes have helped increase the number of repeat visits of existing customers to both stores and online. More than 50 million customers have visited JCPenney in the past three years, he said. After about five years of declines, it’s now seeing customers coming to JCPenney more frequently — a 5% increase. As for its beauty departments,25% are new customers, he noted.

“That's showing us that if we get the basic relevant experience right, then they’re going to come to us more frequently because they know the brand, they’re shopping for us already and they’re now starting to shop across more areas of the store and come more frequently, ” he said.

Rosen arrived at JCPenney when its annual revenue was around $8 billion to $9 billion and that number was unchanged last year. He expects it could decline slightly this year because of all the economic uncertainty. It had annual sales of roughly $11.2 billion when it filed for bankruptcy.

Neil Saunders, managing director of GlobalData Retail, said he was recently at a JCPenney store in Phoenix, and the stores looked messy, and there were gaps on shelves. But he did praise the beauty area.

“They may have steadied the ship, but they have not revived the brand,” he said.

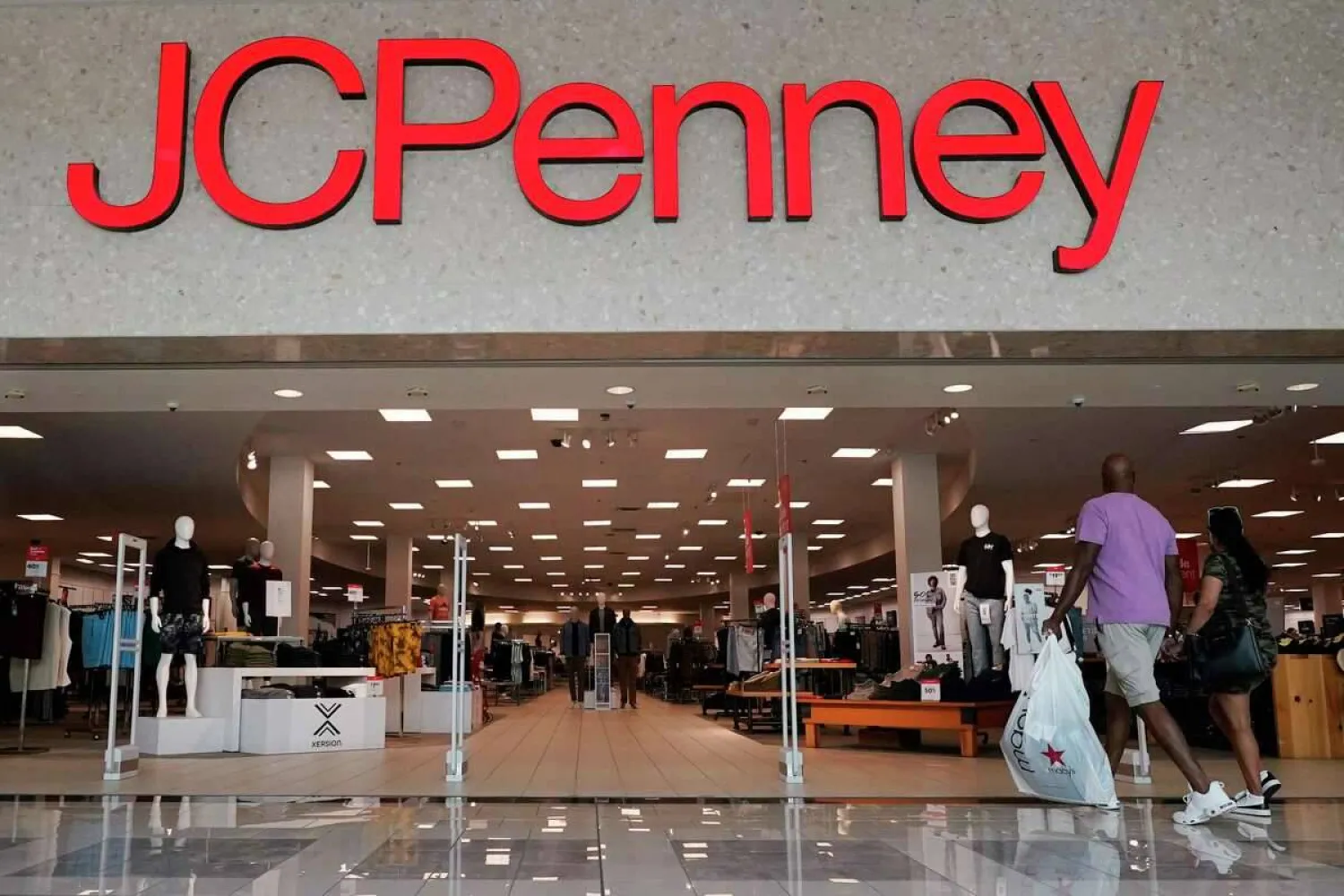

JCPenney is Spending $1 Billion on Store and Online Upgrades in Latest Bid to Revive Its Business

The JCPenney sign lights up the entrance to a store in Frisco, Texas, Wednesday, Aug. 30, 2023. LM Otero/AP

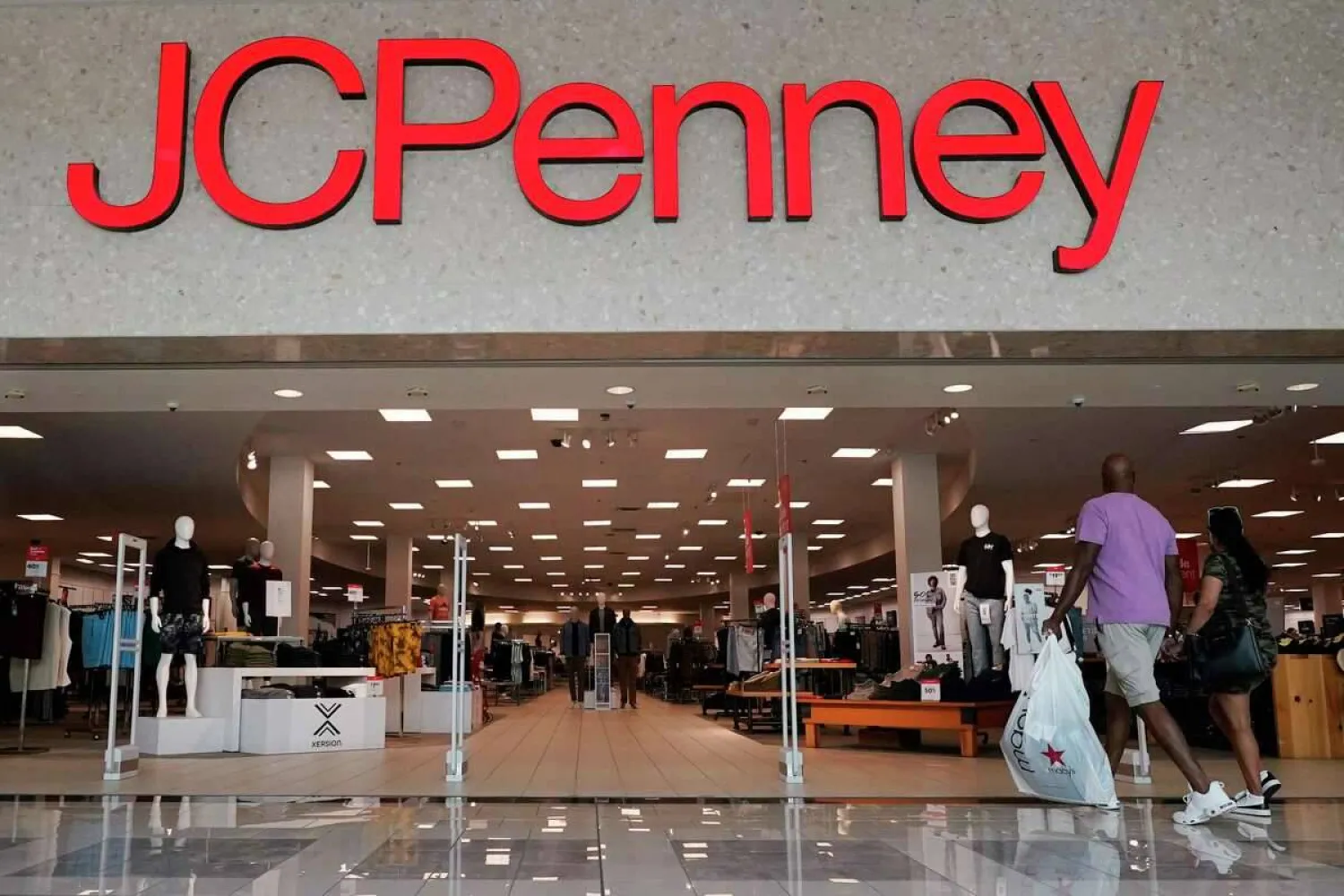

JCPenney is Spending $1 Billion on Store and Online Upgrades in Latest Bid to Revive Its Business

The JCPenney sign lights up the entrance to a store in Frisco, Texas, Wednesday, Aug. 30, 2023. LM Otero/AP

لم تشترك بعد

انشئ حساباً خاصاً بك لتحصل على أخبار مخصصة لك ولتتمتع بخاصية حفظ المقالات وتتلقى نشراتنا البريدية المتنوعة