Iran’s central bank chief said on Monday an agreement has been reached with Iraqi officials to unlock Iranian funds.

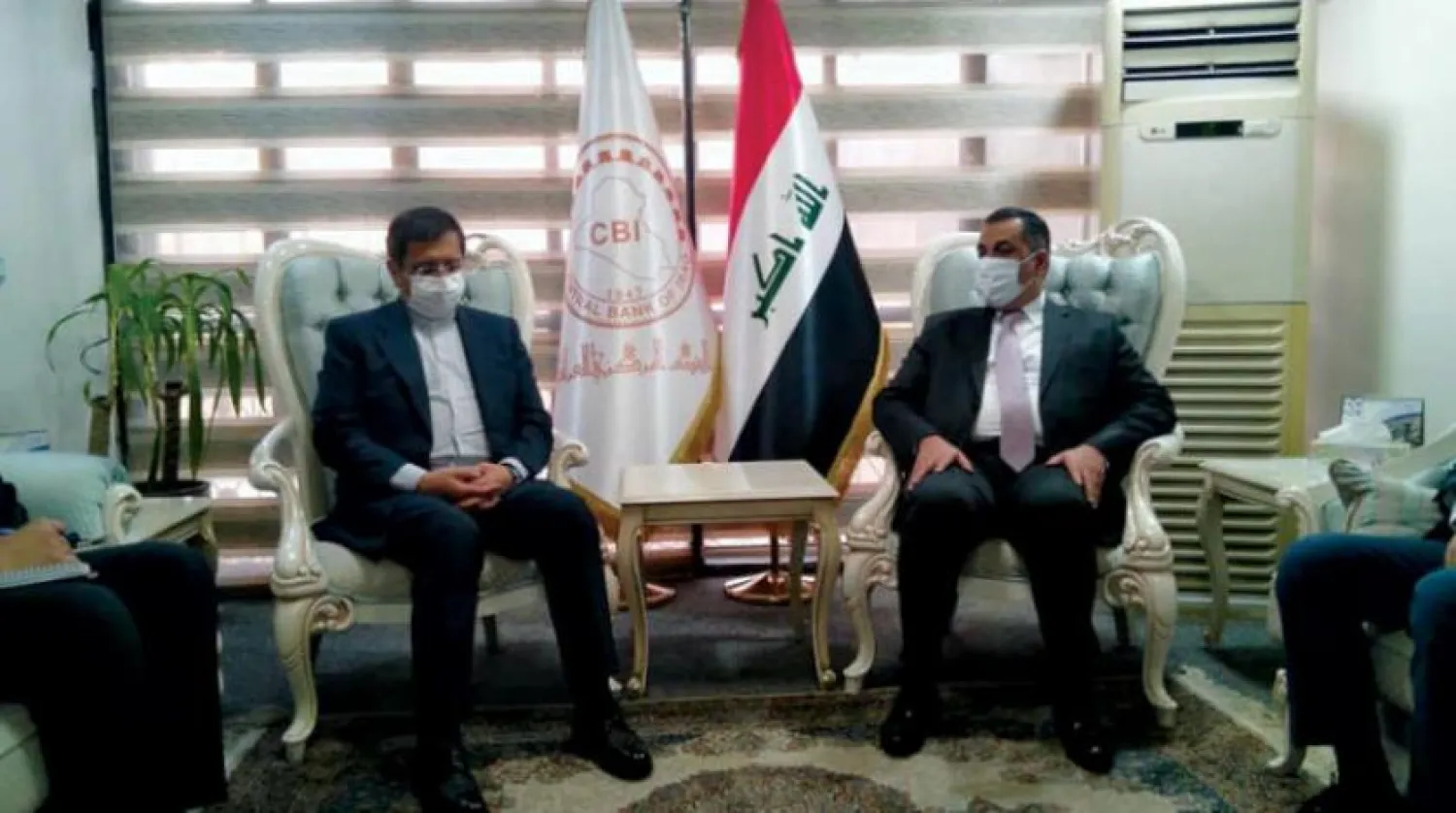

Governor of Central Bank of Iran (CBI) Abdolnaser Hemmati arrived in Baghdad on Monday for a one-day visit to develop banking and trade cooperation.

His remarks were made following talks with Governor of Iraq's Central Bank Mustafa Ghalib Mukheef and Chief of the Trade Bank of Iraq Salem Jawad Abdul Hadi al-Jalabi.

The official Iraqi and Iranian sides said the visit comes in line with bilateral banking cooperation. However, economists say the move aims to reduce the effects of the US sanctions against Tehran.

IRNA quoted Hemmati as saying that he had reached an agreement with officials of Iraq’s Central Bank and the Trade Bank of Iraq on the release of Iran’s financial assets to buy essential goods for the country.

He noted that his country has “significant” financial resources in Iraqi banks. The financial resources are Iran’s revenues derived from the export of electricity and gas to the neighboring country.

Hemmati also met with Iraqi Prime Minister Mustafa al-Kadhimi, who promised to follow up the implementation of the agreement during this week, IRNA reported.

Referring to its positive talks with Iraqi officials, the Governor expressed hope that the agreement would help both countries take positive steps toward developing economic and banking relations.

Fars News Agency of the Iranian Revolutionary Guard Corps said Mukheef proposed that both countries set up a joint committee to explore means to resolve financial issues.

Last week, the US Treasury Department’s Office of Foreign Assets Control (OFAC) sanctioned 18 major Iranian banks.

Secretary Steven T. Mnuchin said this action reflects the commitment to stop illicit access to US dollars.

“Our sanctions programs will continue until Iran stops its support of terrorist activities and ends its nuclear programs,” he stressed, adding that sanctions will continue to allow humanitarian transactions to support the Iranian people.

Commenting on the Iranian official’s visit, Economist and Professor at the Iraqi University Abdulrahman al-Mashhadani said it is very obvious that Iranians are looking for a way out of the crisis created by the US sanctions.

He told Asharq Al-Awsat that the new sanctions against Tehran have affected major Iranian banks that finance the country’s import and export processes.

Facing such a major issue forced Iran to seek, through the Iraqi banking sector, to circumvent these sanctions, especially that it is known to have many banks in Iraq that secretly operate to serve their interests, Mashhadani noted.

Monetary Policy Professor at Baghdad University Ihsan Jaber agreed with Mashhadani that the visit was aimed at facing US sanctions through Iraq.

Jaber told Asharq Al-Awsat that this visit is not beneficial to Iraq, and it may have dire consequences if the US discovers that Iraq has become a conduit for Iranian funds.

The US Treasury has previously enlisted some of the Iraqi banks for their dealings with the IRGC, Lebanese Hezbollah and other groups, he stressed.