Prime Minister Mustafa Al-Kadhimi stated that Iraq was looking forward to establishing a joint industrial and commercial zone with Kuwait to further develop an economic partnership between the two countries.

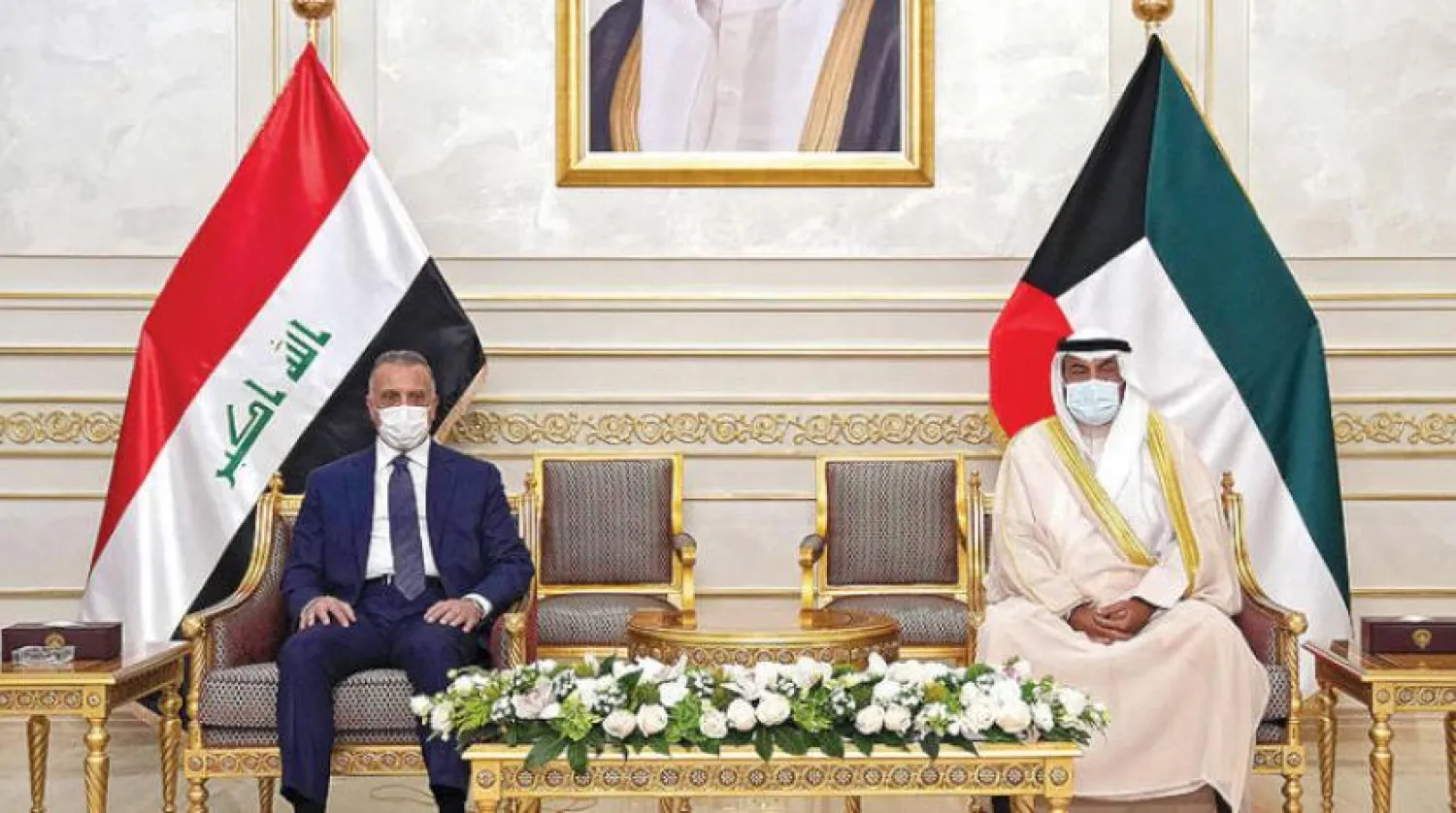

Kadhimi’s comments came during a meeting with Chairman of the Kuwait Chamber of Commerce and Industry Muhammad Jassim Al-Saqer and a large group of businessmen on the sidelines of his visit to Kuwait.

“Iraq is seriously seeking to facilitate the procedures for intra-regional trade with Kuwait, and to raise the volume of trade exchange, which is still below the level of our ambitions,” he stated.

Kadhimi stressed that the Iraqi government has worked to facilitate investment procedures, protect the rights of investors, provide all forms of support for the success of their business, and simplify granting entry visas to Kuwaiti businessmen, noting that Iraq had previously signed an agreement to avoid double taxation with Kuwait in 2019.

“Iraqi-Kuwaiti cooperation in the fields of oil and energy is of great interest to us, and we look forward to developing these relations by encouraging the Kuwaiti side to expedite the implementation of the related Gulf electrical interconnection projects,” he added.

In a separate context, Dr. Mazhar Mohammad Salih, a financial advisor to the Iraqi government, said on Monday that extensive meetings were being held to prepare the draft federal general budget for 2022.

Saleh told the German News Agency that the budget seeks to revive economic growth, reform the financial system, and maximize non-oil revenues, along with oil revenues.

He added that the significant improvement in crude oil prices has resulted in financial revenues that exceeded the USD 45 price ceiling approved by the current year’s budget, and thus the rise in oil prices contributed to filling a large part of the planned budget deficit of 29 trillion Iraqi dinars and stopped resorting to borrowing.