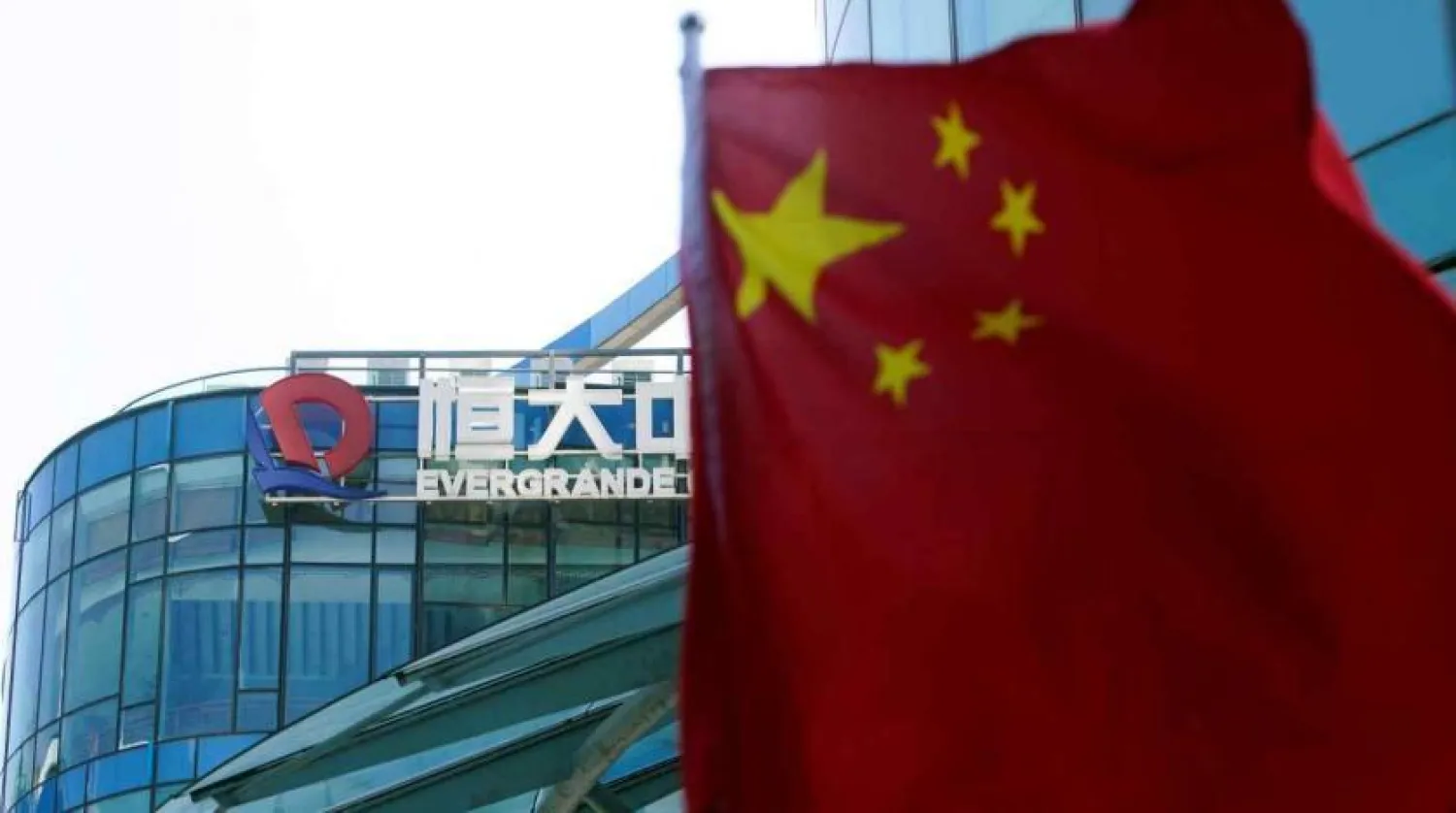

Chinese developer Evergrande met a deadline to pay overdue interest on three US-dollar bonds before their grace periods ended, a report said Thursday, signalling it had averted another potential default and triggering a rally in the troubled firm's shares.

Evergrande shares bounced up in Hong Kong morning trade and were around seven percent up by mid-afternoon, according to AFP.

All eyes had been on the heavily indebted company as it faced a Wednesday deadline for $148 million in coupon payments -- after missing the initial due dates last month.

The liquidity crunch at one of China's biggest property developers has battered investor sentiment and rattled the country's key real estate market, adding to fears of wider contagion.

The 30-day grace periods for the latest interest payments were to end on Wednesday, but customers of international clearing firm Clearstream reportedly received their payments, Bloomberg News reported.

Two investors holding two of the bonds confirmed that they received the payments, Bloomberg added.

Clearstream did not immediately respond to AFP's request for comment.

In October, the company swerved past more looming defaults by making overdue interest payments to offshore bond-holders.

Bogged down in liabilities worth more than $300 billion, the Shenzhen-headquartered developer has been trying to dispose of its assets to raise cash.

It earlier managed to raise around $144 million by slashing its stake in an internet company, with stock exchange filings showing it sold a 5.7 percent stake in HengTen Networks Group in three separate transactions.

Evergrande is among a number of Chinese developers caught in a crackdown on speculation and leverage in the country's colossal property sector, working to rein in excessive debt.

But authorities appear now to be rolling back some of these regulations.

A series of articles published in state media this week suggested more support measures to help developers tap debt markets, with the Securities Times reporting Wednesday that bank lending has been relaxed to make it easier for property companies to raise cash.

The China Securities Journal, Shanghai Securities News and Securities Times all carried similar reports Thursday on their front pages, detailing October credit data from the central bank and saying lending to developers rose in October.

Analysts told state media that the new data showed some loosening of housing financial policies alongside an increase in personal housing loans.