India is the third largest oil consumer in the world and accounts for 30 percent of global consumption, announced Indian Energy Minister Hardeep Singh Puri.

The Minister asserted that India diversified its sources of energy imports but would continue to buy most of its oil from the Middle East for a long time.

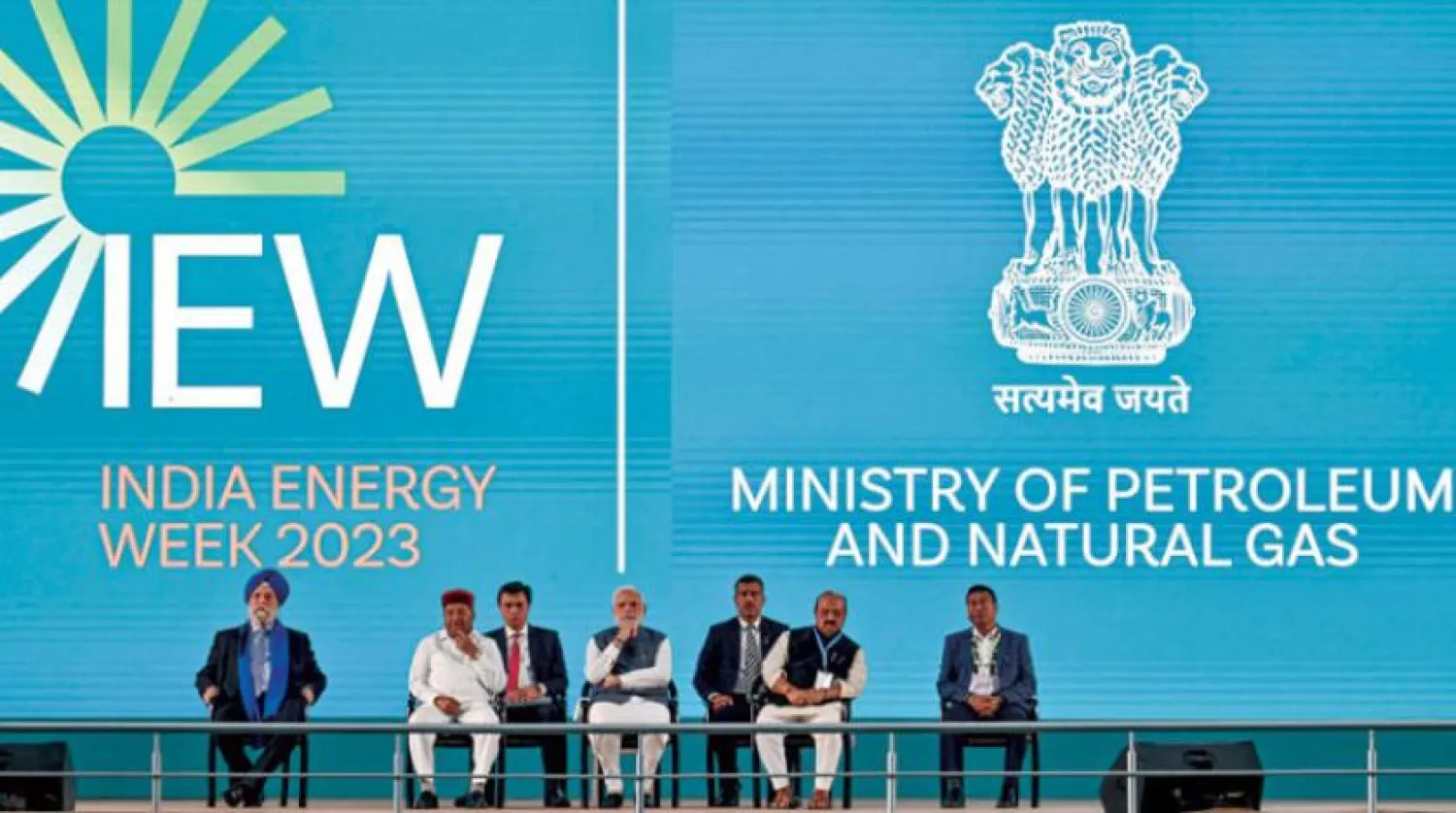

"I continue to maintain that the Gulf, countries of the gulf, will continue to be major suppliers and account for a large percentage of our imports for a long time to come," Hardeep Singh Puri told reporters at India Energy Week.

He also said India would consider buying oil from Iran and Venezuela if sanctions are lifted and would continue purchases from Russia if prices "continue to be good."

Oil prices rose during Wednesday's trading, despite their decline in the middle of the session, after the release of US Energy Information Administration data.

Comments from US Federal Reserve Chair Jerome Powell on Tuesday were seen as less hawkish than feared, boosting risk appetite and weighing on the dollar.

A weaker US currency makes dollar-denominated oil cheaper for buyers holding other currencies.

Brent crude futures rose 0.4 percent to $84.03 a barrel, while US West Texas Intermediate crude rose 0.8 percent, to $77.80 a barrel, after jumping 4.1 percent in the previous session.

The dollar index was down slightly at 103.29 in early trade, extending losses after Powell's comments on Tuesday, making oil cheaper for those holding other currencies.

With less aggressive interest rate hikes in the United States, the market is hoping the world's biggest economy and oil consumer can dodge a sharper slowdown in economic activity or even a recession and avoid a slump in oil demand.

US crude oil stocks rose more than expected to their highest level since June 2021.

Crude inventories rose by 2.4 million barrels in the week ended Feb. 3 to 455.1 million barrels, close to the 2.5 million-barrel rise.

Energy giant BP has reported record annual profits as it scaled back plans to reduce the amount of oil and gas it produces by 2030.

The British company said that it intends to increase its investments in energy sources that are less polluting by allocating an additional $8 billion for this purpose until 2030. It also wants to increase spending on fossil fuel projects by the same value.

Saudi Arabia has repeatedly asserted the importance of fossil fuels for global energy security and renewable energy sources.