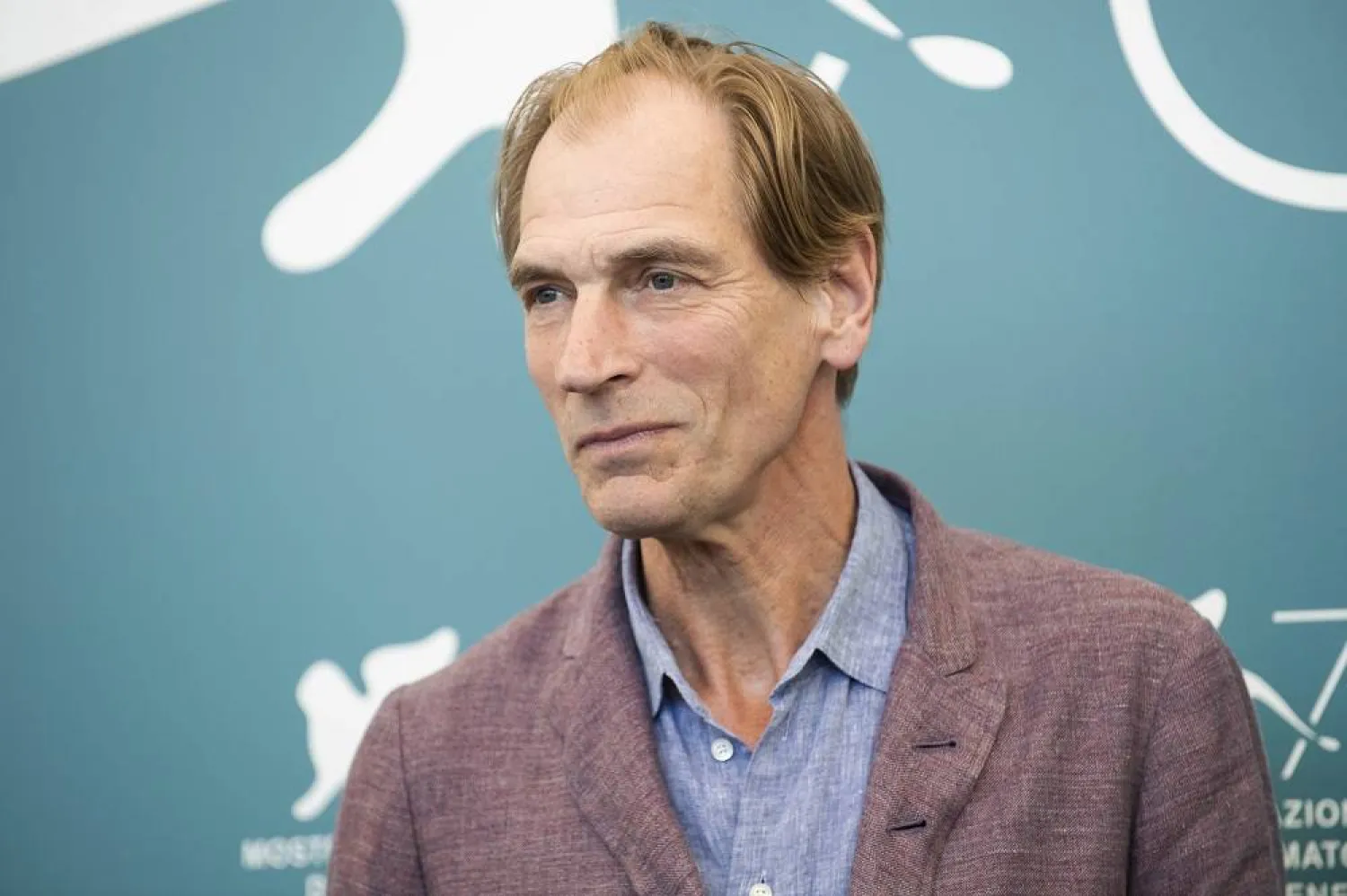

Actor Julian Sands, who starred in several Oscar-nominated films in the late 1980s and ‘90s including “A Room With a View” and “Leaving Las Vegas,” was found dead on a Southern California mountain five months after he disappeared while hiking, authorities said Tuesday.

An investigation confirmed that it was Sands whose remains hikers found Saturday in wilderness near Mount Baldy, the San Bernardino County Sheriff’s Department said.

The 65-year-old actor was an avid and experienced hiker who lived in Los Angeles and was reported missing Jan. 13 after setting out on the peak that rises more than 10,000 feet (3,048 meters) east of the city.

Crews aided by drones and helicopters had searched for him several times, but, severely hampered by wintry conditions that lasted through spring, no sign of him was found until the civilian hikers came upon him.

The chances of Sands being discovered alive had long since diminished to nearly nothing, but the Sheriff’s Department, which conducted an official search the day before he was found, emphasized that the case remained active.

An autopsy has been conducted, but further test results are needed before the cause of death can be determined, authorities said.

Sands, who was born, raised and began acting in England, worked constantly in film and television, amassing more than 150 credits in a 40-year career. During a 10-year span from 1985 to 1995, he played major roles in a series of acclaimed films.

After studying at the Royal Central School of Speech and Drama in London, Sands embarked on a career in stage and film, playing small parts in films including “Oxford Blues” and “The Killing Fields.” He landed the starring role of George Emerson, who falls in love with Helena Bonham Carter’s Lucy Honeychurch while on holiday in Tuscany, in the 1985 British romance, “A Room With a View.”

The film from director James Ivory and producer Ismail Merchant won the British Academy of Film and Television Arts award for best film, and was nominated for eight Oscars, winning three.

In the wake of its success, Sands moved to the United States to pursue a career in Hollywood.

He played the title role in the 1989 horror fantasy “Warlock” and its sequel. In the 1990 horror comedy “Arachnophobia,” with Jeff Daniels and John Goodman, Sands played an entomologist specializing in spiders.

The following year he appeared in director David Cronenberg’s surreal adaptation of the William Burroughs novel “Naked Lunch” in 1991.

In 1993, Sands starred in the thriller “Boxing Helena,” a movie that drew major media attention during production when Madonna and Kim Basinger each accepted the title role before backing out. The part would go to “Twin Peaks” actor Sherilyn Fenn. The film flopped.

Author Anne Rice championed Sands to play the titular Lestat in the much-hyped 1994 Hollywood adaptation of her novel “Interview With the Vampire,” but the role would go to Tom Cruise.

In 1995’s “Leaving Las Vegas,” Sands played an abusive Latvian pimp alongside Nicolas Cage and Elisabeth Shue. The film was nominated for four Oscars, with Cage winning best actor.

Sands touted his love of the outdoors in a 2020 interview with the Guardian, saying he was happiest when “close to a mountain summit on a glorious cold morning” and that his biggest dream was scaling “a remote peak in the high Himalayas, such as Makalu.”

The actor said in the interview that in the early 1990s, he was caught in an “atrocious” storm in the Andes and was lucky to survive when three others near his party didn’t.

After “Leaving Las Vegas,” the quality of the films Sands was cast in, and the size of his roles, began declining. He worked steadily, appearing in director Wim Wenders’ “The Million Dollar Hotel” and director Dario Argento’s “The Phantom of the Opera.”

He also appeared as a guest star or in recurring roles on TV series including “24,” “Medici,” “Smallville,” “Dexter,” “Gotham” and “Elementary.” His final film was 2022’s “The Ghosts of Monday.”

Sands was born in Yorkshire, the middle child of five brothers raised by a single mother. He had three children of his own.

He had been married since 1990 to journalist Evgenia Citkowitz, with whom he had two adult daughters, Imogen Morley Sands and Natalya Morley Sands. His eldest child was son Henry Sands, whom he had with his first wife, journalist Sarah Harvey.

A few days before he was found, Sands’ family issued a statement saying, “We continue to hold Julian in our hearts with bright memories of him as a wonderful father, husband, explorer, lover of the natural world and the arts, and as an original and collaborative performer.”