Riyadh Air, Saudi Arabia’s new national carrier and a Public Investment Fund company, announced on Wednesday the launch of its first daily flights to London Heathrow Airport, starting October 26. The milestone marks a major step toward achieving full operational readiness and delivering world-class travel experiences.

The airline also unveiled its innovative loyalty program, “Sfeer,” designed to offer exclusive benefits to its early founding members and to redefine the future of loyalty in global aviation, said Riyadh Air in a statement.

Starting October 26, Riyadh Air will operate daily flights between Riyadh and London Heathrow using its Boeing 787-9 aircraft, named “Jamila,” currently serving as the airline’s technical spare. In the initial phase, tickets will be available for select passenger groups and Riyadh Air employees as part of a structured operational program to ensure full readiness ahead of receiving its first new aircraft from Boeing, while also utilizing its newly allocated operational slot at Heathrow Airport.

The inaugural flight RX401 will depart King Khalid International Airport in Riyadh at 3:15 a.m. and arrive at London Heathrow at 7:30 a.m. The return flight RX402 will depart London at 9:30 a.m. and arrive in Riyadh at 7:15 p.m.

This operational phase represents a key milestone in Riyadh Air’s journey, which will soon be followed by additional routes, including Dubai, underscoring the airline’s commitment to excellence. Through comprehensive evaluation of the initial “Jamila” flights, the airline is ensuring world-class readiness and service quality ahead of launching new destinations for the Winter 2025 and Summer 2026 seasons.

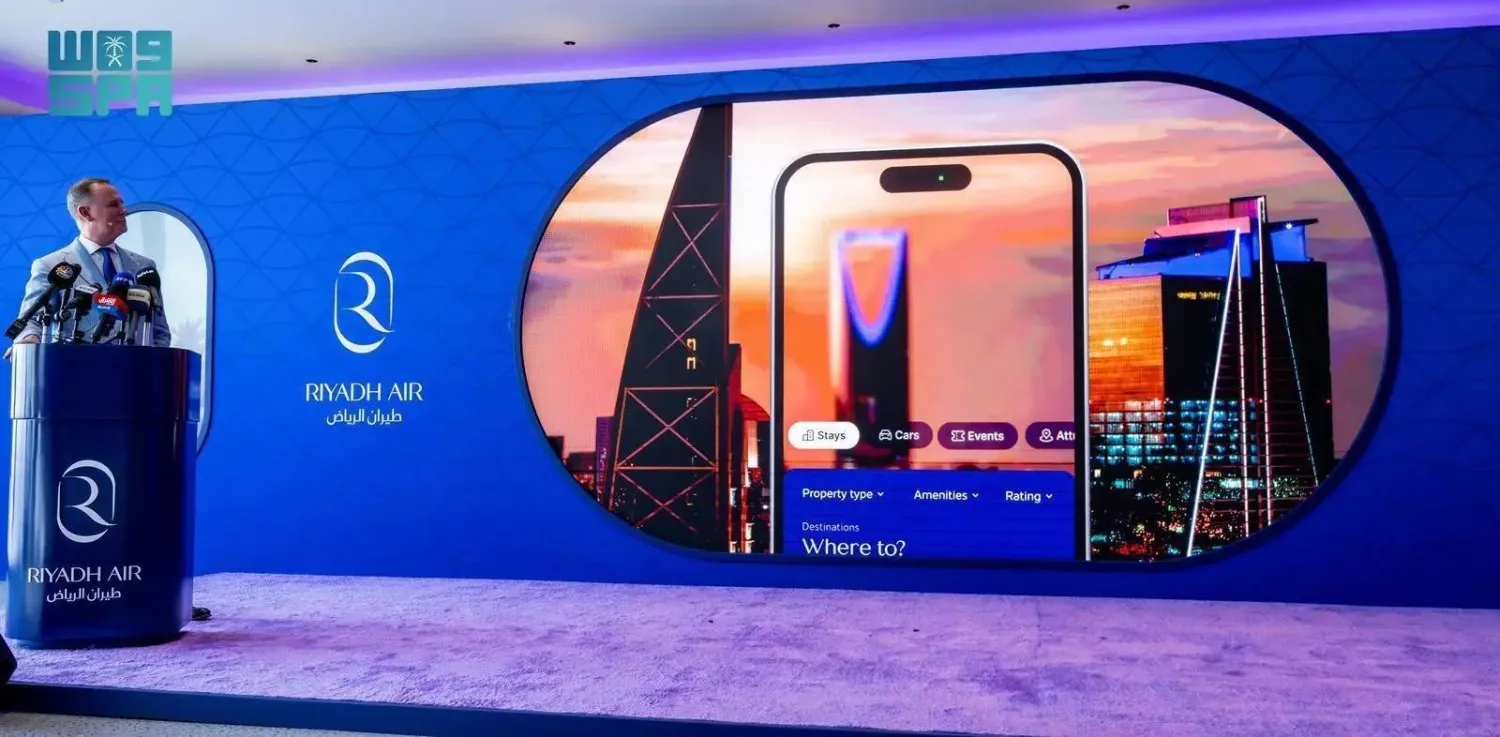

Commenting on the milestone, Riyadh Air CEO Tony Douglas said: “This is more than just the launch of a route, it is the realization of our vision to connect the Kingdom with the world as a driving force of Saudi Vision 2030.”

“Our commitment to begin operations in 2025 is now taking shape. This carefully planned flight program allows us to perfect every operational detail to ensure a seamless, reliable, and world-class travel experience. We are only steps away from full-scale operations, with more destination launches to be announced in the coming weeks,” he added.

Douglas sressed that the new “Sfeer” program combines the Arabic meaning of “Ambassador” with the English word “Sphere,” symbolizing global connection. “Sfeer” enables members to embody Saudi hospitality and represent Riyadh Air internationally. It introduces a unique, community-driven approach to loyalty programs that blends social engagement with innovative digital experiences, allowing members to explore the best of Saudi Arabia.

A distinctive feature of “Sfeer” is its ability to allow members to share Level Points with family and friends, helping them reach higher membership tiers together.

Registration is now open on Riyadh Air’s official website, where early registrants will be granted “Founding Member” status, gaining early access to bookings on Riyadh Air’s first flights and additional exclusive benefits to be announced soon.

The innovative design of “Sfeer” centers on community, enabling members to soon share their points, rewards, and qualified spending with family and friends, reflecting Saudi generosity and collective spirit. By 2026, once fully activated, “Sfeer” will introduce interactive digital challenges, leaderboards, and a “no points expiry” policy, representing a true embodiment of Saudi generosity.

Joining “Sfeer” today grants members immediate benefits and positions them at the forefront of Riyadh Air’s journey. Founding members will enjoy priority booking when commercial flights open for sale and exclusive invitations to special events and experiences.

Over the coming months, all members will have access to unique activities and partnerships with local and international entities, including culinary and entertainment experiences, and opportunities to win free flights and valuable prizes.