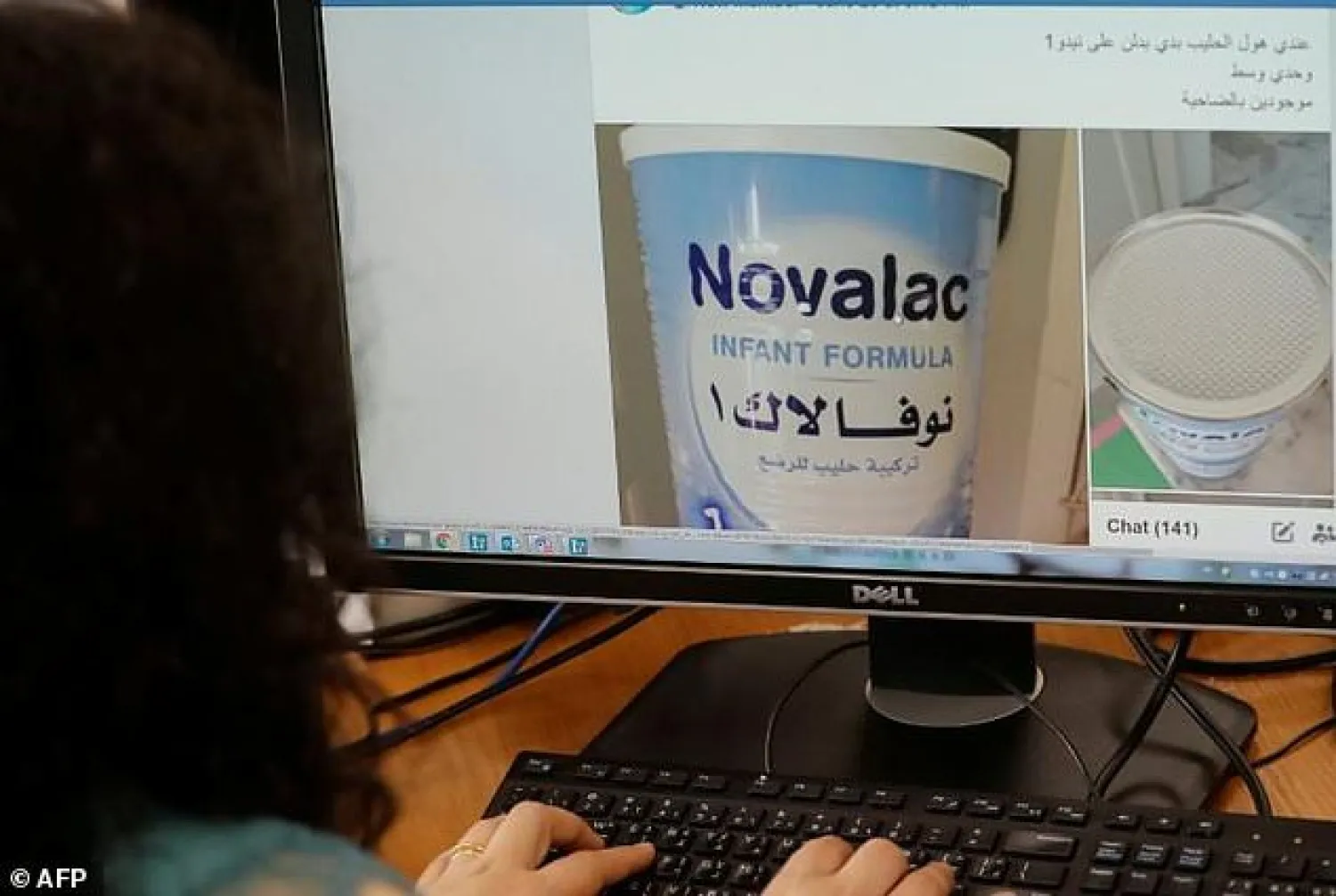

An evening dress for milk formula, children's clothes for cooking oil -- as they watch prices soar in crisis-hit Lebanon, parents are taking to bartering online to survive.

Tens of thousands of people across the social spectrum have lost their job or part of their income because of Lebanon's worst economic crisis in decades.

As the Lebanese pound has plunged to historic lows in the market, many have reverted to non-cash transactions, AFP reported.

On Facebook group known as "Lebanon barters" has attracted 12,000 users in just two weeks.

Among them, Zeinab, 25, is offering a black evening dress in exchange for milk formula and two packets of nappies for her 11-month-old baby boy.

"I've never asked for anything from anyone, so I thought bartering would be better," she said.

"I'd feel more comfortable if I swapped something I didn't need for what I really do."

Although Lebanon's currency is officially pegged at 1,507 pounds to the dollar, a shortage of hard currency has seen that rate plummet to more than 8,000 on the black market.

Aid workers and volunteers say families that were once well-off are now struggling to put bread on the table, let alone pay for medication.

Economists are speaking of the disappearance of the middle class.

Hassan Hasna, founder of the "Lebanon barter" page, said he and others started the group as a practical solution "because people no longer had money in hand".

"But we were surprised by how sad some cases were."

On the page, another mother has asked for something to eat in exchange for some of her five-year-old daughter's clothes.

A third woman said she can provide two food parcels in exchange for cleaning products and anything useful for her children.

Instead of food, Nourhan requested a physiotherapy session for a friend's child with cerebral palsy, and said she would hand over decorative trays and a box as compensation.

"She initially tried to sell it but I suggested she swap it instead as people are no longer able to pay or buy anything," she noted.

"She agreed because she had no other option" after her husband lost his job, said Nourhan, who has since received offers of free doctor consultations and donations.

According to AFP, second page called "Libantroc" was also set up at the end of last year for bartering, and now has 50,000 users.

"The page grew very fast as unemployment increased and increasingly more people found themselves in need," said its founder, Hala Dahrouj.

Some were suddenly forced to sleep in the street and used the page to find shelter or ask for help to pay rent, Dahrouj said.

But although it was started for bartering, today many users simply use it to seek help, said volunteer administrator Carla el-Zoghbi.

"Lots of people have requests but they no longer have anything to swap for it," she said.

The Lebanese economic crisis has plunged 45 percent of the population into poverty, according to official estimates.