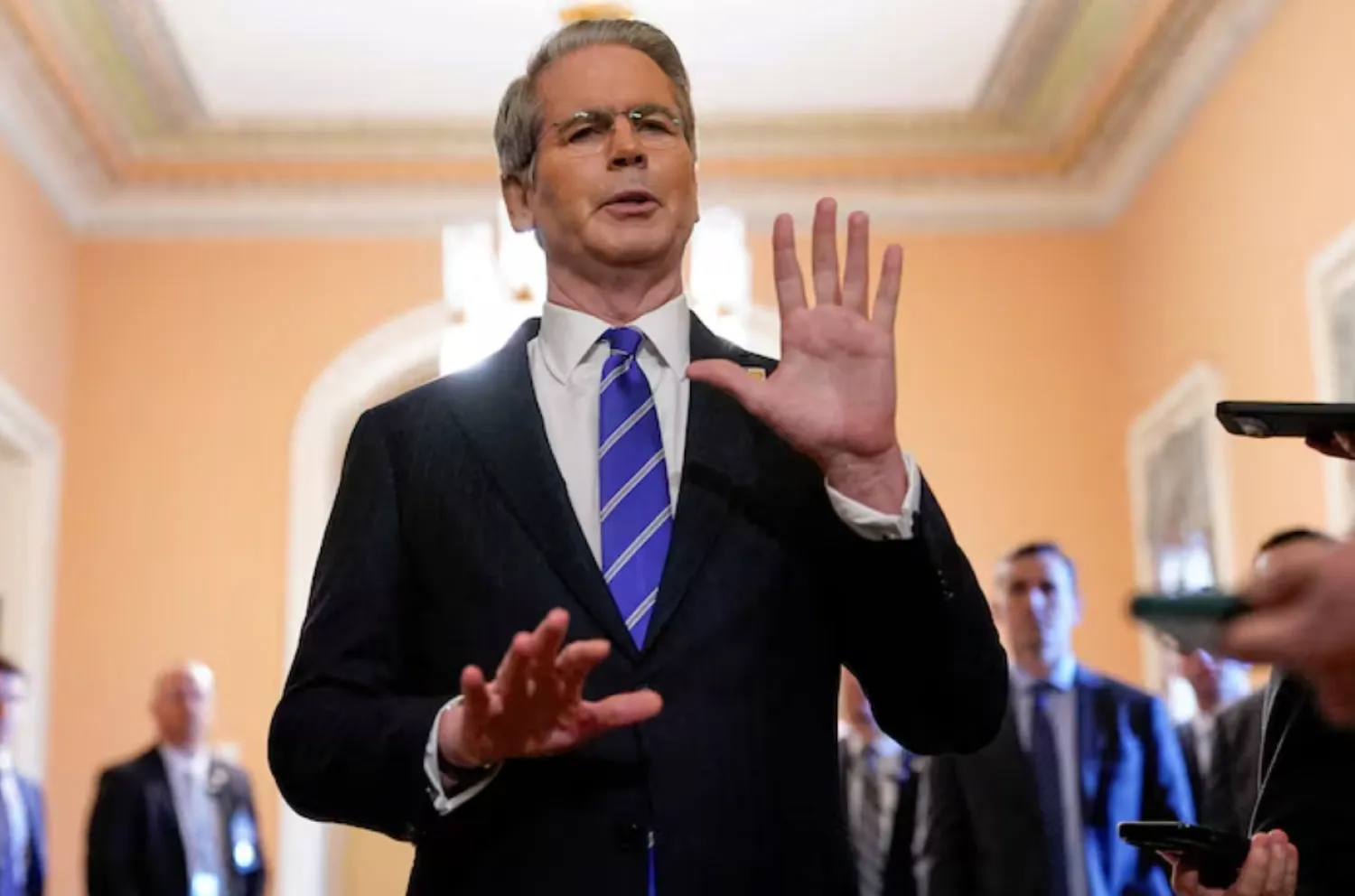

The United States is close to clinching several trade deals ahead of a July 9 deadline when higher tariffs kick in, US Treasury Secretary Scott Bessent said on Sunday, predicting several big announcements in coming days.

Bessent told CNN's "State of the Union" the Trump administration would also send out letters to 100 smaller countries with whom the US doesn't have much trade, notifying them that they would face higher tariff rates first set on April 2 and then suspended until July 9.

"President Trump's going to be sending letters to some of our trading partners saying that if you don't move things along, then on August 1 you will boomerang back to your April 2 tariff level. So I think we're going to see a lot of deals very quickly," Bessent said.

Bessent denied that August 1 was a new deadline for negotiations. "We are saying this is when it's happening. If you want to speed things up, have at it. If you want to go back to the old rate, that's your choice," he told CNN, Reuters reported.

The US Treasury chief said the Trump administration was focused on 18 important trading partners that account for 95% of the US trade deficit. But he said there had been "a lot of foot-dragging" among countries in getting closure on a trade deal.

He declined to name countries that were close to a trade agreement, adding, "because I don't want to let them off the hook."

Trump has repeatedly said India is close to signing a deal and expressed hope that an agreement could be reached with the European Union, while casting doubt on a deal with Japan.

Since taking office, the US president has set off a global trade war that has upended financial markets and sent policymakers scrambling to guard their economies, including through deals with the US and other countries.

Trump on April 2 announced a 10% base tariff rate and additional amounts for most countries, some ranging as high as 50%. The news roiled financial markets, prompting Trump to suspend all but the 10% base rate for 90 days to allow more time for negotiations to secure deals, but the process has proven more challenging than expected.

That period ends on July 9, although Trump early on Friday said the tariffs could be even higher - ranging up to 70% - with most set to go into effect August 1.

Bessent, asked about the 70% rate, referred back to the April 2 list, but that did not include such high rates.